Seaborne exports of Russian oil and petroleum products from the Black Sea between the two embargoes. Main trends: Crude oil

The Monitoring Group of BlackSeaNews

and the Black Sea Institute of Strategic Studies

The Monitoring Group of the Black Sea Institute of Strategic Studies and BlackSeaNews, based on its own monitoring results, reports on the main trends in seaborne export of Russia’s oil and petroleum products from the Black Sea between the two embargoes (the first embargo – on Russian seaborne crude oil exports to EU countries – has been effective since 5 December 2022; the second one – on Russian petroleum products – will come into effect on 5 February 2023).

Summary

According to preliminary estimates, in January 2023, Russia's seaborne crude oil exports from the Black Sea will increase significantly. This growth will be from 15 to 35%, and the volume of exports will reach 3.4-4.2 million tons compared with 2.9 million tons in December 2022 - depending on how many tankers with Russian crude oil will pass through the Turkish straits in the last days of January 2023.

This exceeds the 14.4% increase in Russian crude oil exports from Black Sea ports, which occurred in December 2022 - the first month after the EU embargo and the price cap on Russia’s oil exports to other countries (in case European oil tankers and insurance companies are used for this) came into effect. This growth occurred mainly due to India.

For a relatively small volume of crude oil exports from the Black Sea in December 2022, Russia managed to replace 2/3 of the Greek oil tankers that previously shipped Russian oil to non-EU countries with vessels from non-European states. In December 2022, 24.7% of this oil was subject to the price cap, and 75.3% of the oil did not fall within the scope of the restriction as it was transported by tankers that did not belong to EU shipowners.

The full text of the report

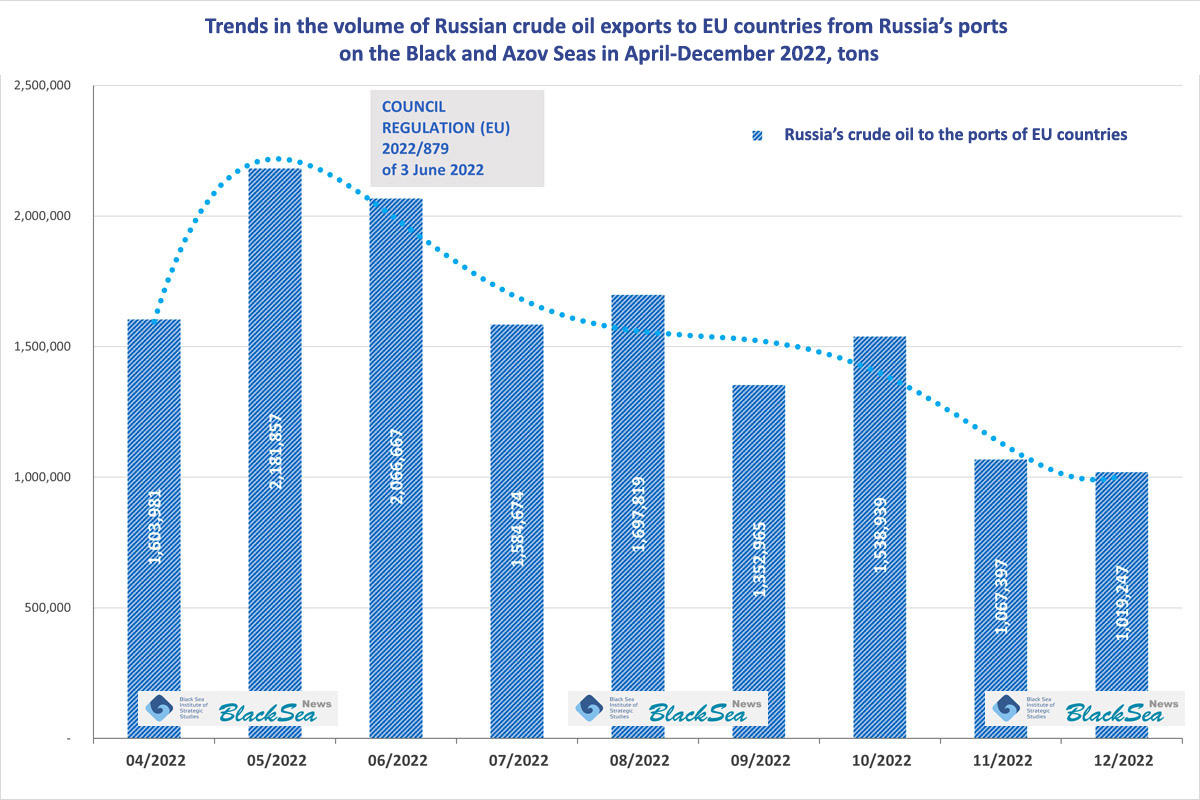

It remained at the level of 1 million tons, the same as in November 2022.

Violations of the embargo by Greece, Spain, and Italy, which were reported, were the main factor behind this seemingly strange phenomenon.

This was not the highest volume, as the maximum export volume reached about 2.3 million tons in June and September 2022.

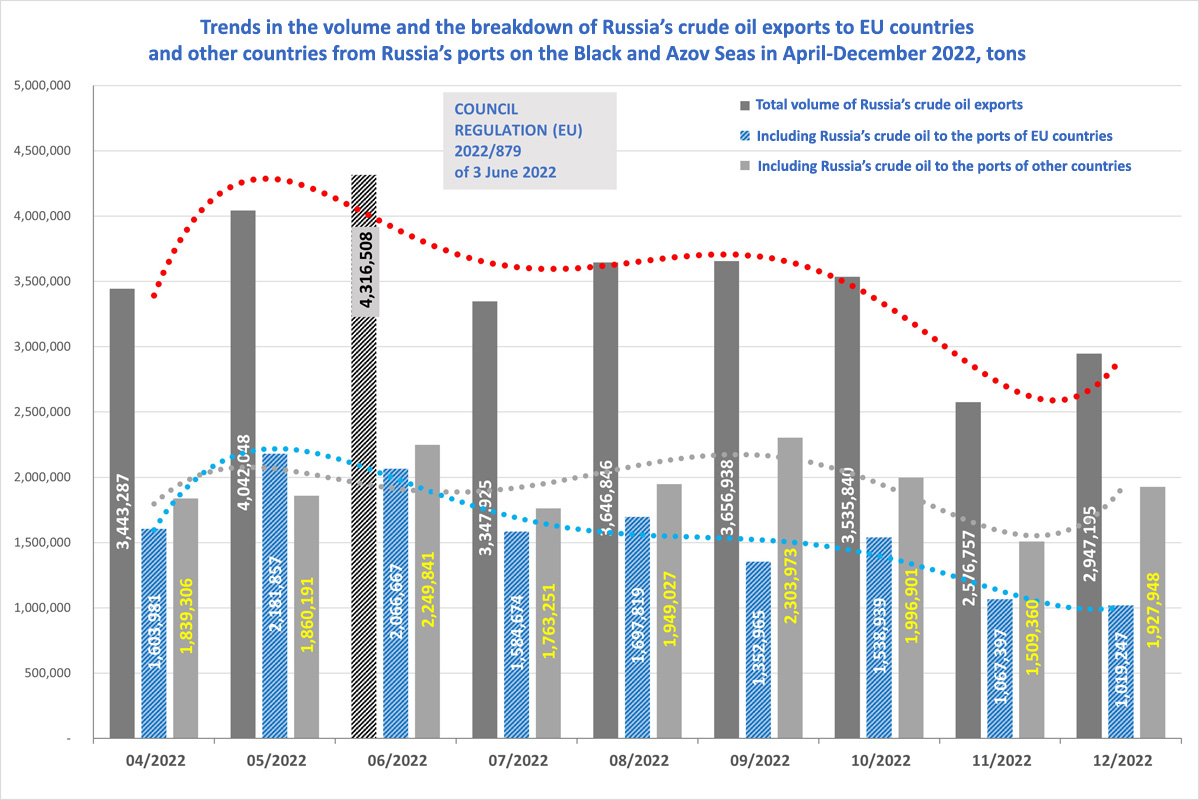

Thus, the total volume of Russia’s crude oil exports from Black Sea ports in December 2022 – the first month after the EU embargo and the price cap on Russia’s oil exports to other countries (in case European oil tankers and insurance companies are used for this) came into effect – increased compared to November and amounted to about 2.9 million tons (See Table 1 for details).

The increase in Russian crude oil exports from Black Sea ports in December 2022 occurred mainly due to India. This country has been the largest importer of Russian seaborne crude oil (See Table 2 for details).

Now, let’s look at who transported Russia’s crude oil from the Black Sea to non-EU countries in December 2022, after the price cap was introduced.

Starting from 05 December 2022, when the price cap was imposed, 10 tankers with Russian crude oil left the Black Sea for non-EU countries. The breakdown of these oil tankers by country of shipowner registration is as follows.

-

Greece – 3

-

Hong Kong, China – 2

-

The United Arab Emirates – 2 (of which 1 tanker is registered with a subsidiary of the Russian company Sovkomflot/Novoship)

-

Russia – 1

-

Turkey – 1

-

India – 1

According to our monitoring data, in December 2022, starting from 5 December 2022, the date of the price cap introduction, about 1.3 million tons of Russian oil were transported to non-EU countries. 24.7% of this oil was subject to the price cap, and 75.3% of the oil did not fall within the scope of the restriction as it was transported by tankers that did not belong to carriers from the EU. In absolute numbers, these were 3 and 7 tankers respectively (See Table 3 for details).

In the previous month, November 2022, Russia’s crude oil was transported to non-EU countries by 14 tankers, 9 of which, i.e. 64%, belonged to Greek shipowners.

Thus, for a relatively small volume of crude oil exports from the Black Sea in December 2022, Russia managed to replace 2/3 of the Greek oil tankers with vessels from other countries.

Note that among these tankers, we have not recorded any that could be confidently assumed to belong to the so-called "grey fleet," which had allegedly been purchased by Russia to circumvent the price cap.

And in conclusion, a few words about forecasts.

According to preliminary estimates by the Monitoring Group, in January 2023, Russia's seaborne crude oil exports from the Black Sea will increase significantly. This growth will be from 15 to 35%, and the volume of exports will reach 3.4-4.2 million tons compared with 2.9 million tons in December 2022 - depending on how many tankers with Russian crude oil will pass through the Turkish straits in the last days of January 2023.

In our next article in a few days, we will be able to look at the situation in more detail.

Table 1. The volume of Russia’s crude oil exports from Black Sea ports in April-December 2022

| Month/Year | 04/2022 | 05/2022 | 06/2022 | 07/2022 | 08/2022 | 09/2022 | 10/2022 | 11/2022 | 12/2022 |

| Total Russia’s crude oil exports, tons | 3,443,287 | 4,042,048 | 4,316,508 | 3,347,925 | 3,646,846 | 3,656,938 | 3,535,840 | 2,576,757 | 2,947,195 |

|

including to EU ports |

1,603,981 | 2,181,857 | 2,066,667 | 1,584,674 | 1,697,819 | 1,352,965 | 1,538,939 | 1,067,397 | 1,019,247 |

|

including to non-EU countries |

1,839,306 | 1,860,191 | 2,249,841 | 1,763,251 | 1,949,027 | 2,303,973 | 1,996,901 | 1,509,360 | 1,927,948 |

Table 2. Exports of Russia’s crude oil from Black Sea ports to non-EU countries in April-December 2022

| 2022, tons | 04/2022 | 05/2022 | 06/2022 | 07/2022 | 08/2022 | 09/2022 | 10/2022 | 11/2022 | 12/2022 | +/- | +/- % |

| Countries/ Total |

1,839,306 |

1,860,191 |

2,249,841 |

1,763,251 |

1,949,027 |

2,303,973 |

1,996,901 |

1,509,360 |

1,927,948 |

+418,588 |

27.7% |

|

India [IN] |

898,590 |

880,238 |

882,955 |

881,667 |

614,792 |

893,580 |

456,695 |

429,218 |

733,588 |

+304,370 |

+70.9% |

|

Turkey [TR] |

264,481 |

113,563 |

634,608 |

540,162 |

731,906 |

683,405 |

915,004 |

341,119 |

266,557 |

-74,562 |

-21.9% |

|

China [CN] |

309,220 |

159,901 |

163,292 |

149,995 |

+149,995 |

||||||

|

Brazil [BR] |

115,756 |

111,610 |

109,999 |

109,995 |

105,547 |

109,999 |

105,547 |

-4,452 |

-4.0% |

||

|

UA Emirates [AE] |

732,278 |

71,522 |

185,888 |

195,498 |

71,498 |

146,521 |

113,849 |

-32,672 |

-22.3 |

||

|

Russia [RU] |

231,680 |

219,895 |

|||||||||

|

Korea [KR] |

109,999 |

||||||||||

|

Singapore [SG] |

115,666 |

158,531 |

219,687 |

109,570 |

220,376 |

110,806 |

101.1 |

||||

|

Sri Lanka [LK] |

115,691 |

|

|||||||||

|

Bahamas [BS] |

106,085 |

112,684 |

103,560 |

107,115 |

-107,115 |

-100.0 |

|||||

|

St Lucia [LC] |

107,023 |

||||||||||

|

Tunisia [TN] |

73,334 |

74,999 |

49,911 |

50,344 |

73,431 |

23,087 |

45.9 |

||||

|

Oman [OM] |

74,581 |

73,334 |

74,999 |

105,475 |

-105,475 |

-100.0 |

|||||

|

Malaysia [MY] |

107,181 |

109,999 |

105,419 |

-4,580 |

-4.2 |

||||||

|

Saudi Arabia [SA] |

159,186 |

159,186 |

Table 3. Shipping of Russia’s crude oil from the Black Sea in December 2022 to non-EU countries (shipping after the price cap came into effect is highlighted in grey)

|

# |

Name |

IMO |

DWT |

Flag |

Port of departure |

Actual Time of Departure |

Port of destination |

Estimated Time of Arrival |

Shipowner |

|

1 |

HORAE Crude Oil Tanker |

9413004 |

105419 |

Panama |

RU KAVKAZ SOUTH ANCH |

ATD: 2022-11-22 01:17 |

MY TPP Malaysia [MY] |

ETA: 2022-12-27 18:00 |

Ship manager/Commercial manager FRACTAL MARINE DMCC Unit 157, Level 5, DMCC Business Centre, Jewellery & Gemplex 2, Dubai, United Arab Emirates. Registered owner HELIOS LINES INC Care of Fractal Marine DMCC, Unit 157, Level 5, DMCC Business Centre, Jewellery & Gemplex 2, Dubai, United Arab Emirates |

|

2 |

VLADIMIR TIKHONOV Crude Oil Tanker

|

9311622 |

162397 |

Liberia |

RU NVS |

ATD: 2022-11-24 16:48 |

IN VAD India [IN] |

ETA: 2022-12-16 09:30 |

Ship manager/Commercial manager SUN SHIP MANAGEMENT Office OT 17-32, 17th Floor, Office Tower, Central Park Towers, Dubai International Financial Centre, PO Box 507065, Dubai, United Arab Emirates. Registered owner BASSETT OCEANWAY LTD Care of SUN Ship Management (D) Ltd, Office OT 17-32, 17th Floor, Office Tower, Central Park Towers, Dubai International Financial Centre, PO Box 507065, Dubai, United Arab Emirates. |

|

3 |

LILA FUJAIRAH Crude Oil Tanker |

9328170 |

113849 |

Liberia |

RU TUA |

ATD: 2022-11-25 06:25 |

AE FJR United Arab Emirates [AE] |

ETA: 2022-12-13 16:00 |

Ship manager/Commercial manager MTM SHIP MANAGEMENT PTE LTD 13-01, 78, Shenton Way, Singapore 079120 Registered owner NORA SEAWAY LTD Care of MTM Ship Management Pte Ltd, 13-01, 78, Shenton Way, Singapore 079120 |

|

4 |

LEOPARD I Crude Oil Tanker

|

9293117 |

159186 |

Liberia |

RU NVS |

ATD: 2022-11-26 07:43 |

SA JEDDAH ANCH Saudi Arabia [SA] |

ATA: 2022-12-16 23:30 |

Ship manager/Commercial manager LEOPARD I SHIPPING INC 80, Broad Street, Monrovia, Liberia. Registered owner LEOPARD I SHIPPING INC 80, Broad Street, Monrovia, Liberia |

|

5 |

CLYDE Crude Oil Tanker |

9269245 |

73431 |

Panama |

RU TUA |

ATD: 2022-12-03 13:24 |

TN LSK Tunisia [TN] |

ETA: 2022-12-17 16:00 |

Ship manager/Commercial manager CHEMNAV SHIPMANAGEMENT LTD National Road Athens, 6, Roupel Street, Athens-Lamia Road, Km 17, Kifisia, 145 64 Athens, Greece. Registered owner CLYDE SHIPPING INVESTMENTS SA Care of Chemnav Shipmanagement Ltd, National Road Athens, 6, Roupel Street, Athens-Lamia Road, Km 17, Kifisia, 145 64 Athens, Greece |

|

6 |

TYCHE 1 Crude Oil Tanker |

9308077 |

150980 |

Panama |

RU NVS |

ATD: 2022-12-07 11:10 |

TR KORFEZ ANCH Turkey [TR] |

ATA: 2022-12-10 16:15 |

Ship manager/Commercial manager SHIP MANAGEMENT SERVICES LTD Room 602, 6th Floor, 168, Queen's Road Central, Hong Kong, China. Registered owner NEMAN SHIPPING INC Care of Ship Management Services Ltd, Room 602, 6th Floor, 168, Queen's Road Central, Hong Kong, China. |

|

7 |

BEKS INDIANA Crude Oil Tanker |

9323986 |

105547 |

Marshall Isl |

RU NVS |

ATD: 2022-12-07 04:48 |

BR TRM Brazil [BR] |

ETA: 2022-12-31 09:00 |

Ship manager/Commercial manager BEKS GEMI ISLETMECILIGI VE TIC Kore Sehitleri Caddesi 48/50, Esentepe Mah, Sisli, 34394 Istanbul, Turkey. Registered owner SIRIUS MARITIME & TRADING INC Care of Beks Gemi Isletmeciligi ve Ticaret AS (Beks Shipmanagement & Trading SA), Kore Sehitleri Caddesi 48/50, Esentepe Mah, Sisli, 34394 Istanbul, Turkey. |

|

8 |

NS BORA Crude Oil Tanker |

9412335 |

156697 |

Liberia |

RU NVS |

ATD: 2022-12-08 17:37 |

IN VAD India [IN] |

ETA: 2023-01-02 10:30 |

Ship manager/Commercial manager SUN SHIP MANAGEMENT Office OT 17-32, 17th Floor, Office Tower, Central Park Towers, Dubai International Financial Centre, PO Box 507065, Dubai, United Arab Emirates. Registered owner NS BORA SHIPPING INC Care of SUN Ship Management (D) Ltd, Office OT 17-32, 17th Floor, Office Tower, Central Park Towers, Dubai International Financial Centre, PO Box 507065, Dubai, United Arab Emirates. |

|

9 |

MINERVA KALLISTO Crude Oil Tanker |

9853008 |

112802 |

Greece |

RU NVS |

ATD: 2022-12-08 13:47 |

SG SIN Singapore [SG] |

ETA: 2023-01-02 18:00 |

Ship manager/Commercial manager MINERVA MARINE INC 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73 Athens, Greece. Registered owner BUBO SHIPPING SA Care of Minerva Marine Inc, 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73 Athens, Greece |

|

10 |

IKARA Crude Oil Tanker |

9321718 |

158920 |

Panama |

RU NVS |

ATD: 2022-12-10 01:54 |

IN SIK India [IN] |

ETA: 2023-01-06 14:30 |

Ship manager/Commercial manager FRACTAL MARINE DMCC Unit 157, Level 5, DMCC Business Centre, Jewellery & Gemplex 2, Dubai, United Arab Emirates. Registered owner IKARA LINES INC Care of Fractal Marine DMCC, Unit 157, Level 5, DMCC Business Centre, Jewellery & Gemplex 2, Dubai, United Arab Emirates. |

|

11 |

MISCA Crude Oil Tanker |

9249312 |

149995 |

Panama |

RU NVS |

ATD: 2022-12-15 12:49 |

CN QDG China [CN] |

ETA: 2023-01-24 16:00 |

Ship manager/Commercial manager CONRAD MANAGEMENT CO Block 2, ul Zolotorozhskiy Val 32, Moscow, 111033, Russia. Registered owner ARVE SHIPPING INC Care of Conrad Management Co, Block 2, ul Zolotorozhskiy Val 32, Moscow, 111033, Russia. |

|

12 |

EUROSTRENGTH Crude Oil Tanker |

9543524 |

104594 |

Liberia |

RU TUA |

ATD: 2022-12-17 13:18 |

IN SIK India [IN] |

ETA: 2023-01-09 23:30 |

Ship manager/Commercial manager EUROTANKERS INC 5th Floor, 99, Akti Miaouli, 185 38 Piraeus, Greece. Registered owner ALBERTI MARINE INCCare of Eurotankers Inc, 5th Floor, 99, Akti Miaouli, 185 38 Piraeus, Greece. |

|

13 |

TYCHE 1 Crude Oil Tanker |

9308077 |

150980 |

Panama |

RU NVS |

ATD: 2022-12-17 14:48 |

IN SIK India [IN] |

ETA: 2023-01-08 22:30 |

Ship manager/Commercial manager SHIP MANAGEMENT SERVICES LTD Room 602, 6th Floor, 168, Queen's Road Central, Hong Kong, China. Registered owner NEMAN SHIPPING INC Care of Ship Management Services Ltd, Room 602, 6th Floor, 168, Queen's Road Central, Hong Kong, China. |

|

14 |

ALEXIA Crude Oil Tanker |

9389966 |

107574 |

Marshall Islands |

RU TAM |

ATD: 2022-12-21 17:38 |

SG SIN Singapore [SG]

|

ETA: 2023-01-18 07:00 |

Ship manager/Commercial manager MARINE TRUST LTD-MAI Vergoti Square, Glyfada, 166 75 Athens, Greece. Registered owner MAGDALENA NAVIGATION CORP Care of Marine Trust Ltd, Vergoti Square, Glyfada, 166 75 Athens, Greece. |

|

15 |

ODYSSEUS Crude Oil Tanker |

9332810 |

115577 |

St Kitts Nevis |

RU NVS |

ATD: 2022-12-24 13:44 |

TR KORFEZ ANCH Turkey [TR] |

ATA: 2022-12-27 22:21 |

Ship manager/Commercial manager GATIK SHIP MANAGEMENT M/S E-306, 3rd Floor, Eastern Business District, Neptune Magnet Mall, Lal Bahadur Shastri Road, Bhandup (W), Mumbai, 400078, India. Registered owner NEW ODYSSEY INC Care of m/s Gatik Ship Management, E-306, 3rd Floor, Eastern Business District, Neptune Magnet Mall, Lal Bahadur Shastri Road, Bhandup (W), Mumbai, 400078, India. |

* * *

Important notes:

a) The Russian Federation exports crude oil and petroleum products (fuel oil, gas oil, solar oil) from the ports on the Black and Azov Seas. They are exported by different types of vessels – crude oil tankers and oil/chemical tankers (or oil products tankers) respectively. Crude oil tankers are usually very large: in the Black Sea, one such tanker takes from 100 to 150 thousand tons of crude oil. Oil products tankers have a significantly lower freight-carrying capacity: the commonest are in the ranges of 3-5 and 25-30 thousand tons. The monthly ratio between the volume of exports of Russia’s crude oil and petroleum products is approximately 3:1.

b) Two separate streams of crude oil are exported from Black Sea ports: crude oil of the Russian Federation (from the ports of Novorossiysk, Taman, and Tuapse, from the transshipment points in the Kerch Strait and to the south of it) and crude oil of the Caspian Pipeline Consortium (CPC) - from a separate terminal of the port of Novorossiysk. The CPC’s crude oil contains 80% of Kazakh oil and 20% of Russian oil. Russian oil is under international sanctions. Kazakh oil is not under sanctions, and this mixing creates a potential problem. For more details, see https://www.blackseanews.net/en/read/191374

c) In tables and figures presenting the volume of crude oil and petroleum products exports, the term DWT (deadweight) is used - a measure of how much weight a ship can carry. It is the sum of the weights of cargo, fuel, lubricants, technical and drinking water, passengers, luggage, crew, and provisions. When analysing the transportation of large volumes of oil and petroleum products, other types of cargoes carried by a ship do not significantly influence the results, since even on tankers with a deadweight of 100-150 thousand tons, the sum of the weights of fuel, water, provisions, and a small crew is in the hundreds of tons and does not affect the results of the analysis.

d) This analytical report does not take into account the export volume of crude oil and petroleum products from the Russian Federation to the Black Sea ports and transshipment points of Romania and Bulgaria.

Reference: In July 2022, these exports were estimated to be around 3.1 million tons (1.9 million tons to Romania and 1.2 million tons to Bulgaria). Of these volumes, Russia’s crude oil accounted for about 2.4 million tons (1.4 million tons to Romania and 1.0 million tons to Bulgaria).

e) In tables and figures, for convenience, the term "EU+" is used, which covers not only EU member states but also the USA, the UK, and Monaco. The appropriateness of such grouping is justified by the fact that the exports of oil and petroleum products of the Russian Federation to these countries are very insignificant.

f) In the database of oil tankers at the end of the article, “Crude oil tanker CPC” means that this tanker carries oil from the Caspian Pipeline Consortium’s terminal. Tankers carrying crude oil of the Russian Federation are marked as "Crude oil tankers."

* * *

More on the topic

- 17.04.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of March 2025 Violations

- 16.04.2025 Russian Crude Oil Imports to the EU Embargo: Database of March 2025 Violations

- 15.04.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: March 2025 Database

- 14.04.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of March 2025 Violations

- 11.04.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of March 2025 Violations

- 10.04.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: March 2025 Database

- 19.03.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of February 2025 Violations

- 18.03.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of February 2025 Violations

- 12.03.2025 Russian Crude Oil Imports to the EU Embargo: Database of February 2025 Violations

- 11.03.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of February 2025 Violations

- 10.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: February 2025 Database

- 05.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: February 2025 Database