Where Russian Crude Oil was Transported from the Black Sea during the EU and G7 Embargo (4)

The Monitoring Group of BlackSeaNews and

the Black Sea Institute of Strategic Studies

Based on the results of its own monitoring (see Bloody Oil), the Monitoring Group of the Black Sea Institute of Strategic Studies and BlackSeaNews presents below an analysis of Russian crude oil exports from the Black Sea seaports over the period of the EU/G7 embargo — 05.12.2022-31.12.2023.

For reference: on December 5, 2022, the EU embargo on Russian marine oil imports (except for Bulgaria) came into force, leaving only pipeline deliveries available. In addition, the EU, together with the US and the G7, introduced a mechanism of limiting the price of Russian oil supplied to those countries that were not part of the embargo.

This mechanism consists of a ban on the provision of maritime services for the transportation of Russian oil to third countries and insurance of such cargoes if its price exceeds a certain ceiling, i.e., price cap. The price cap has been set at $60 per barrel.

The purpose of the scheme was to reduce Russia's revenues from energy exports, while avoiding an oil price hike if the interruption of supplies led to a temporary fuel shortage on the world market.

* * *

In Part 1 of the Exports of Russian Crude Oil from Black Sea Seaports Over the Period of the EU/G7 Embargo — December 5, 2022 - December 31, 2023 (1) we reported that since the start of the EU embargo, the total of 47.5 million tons of Russian crude oil have been exported from Russia's Black Sea ports to various countries. 41,09% of that amount, i.e. 19,6 million tons, have been carried by the vessels of European shipowners.

In Part 2 — Who Transported Russian Crude Oil from the Black Sea Ports Since the EU and G7 Embargo has been Imposed (2) — we published our calculations that over the entire 05.12.2022-31.12.2023 period, Greek shipowners transported the largest amount of Russian crude oil –- 36.53% of total shipments, or 17.4 million tons.

Russian companies, including those registered or re-registered in the UAE and created for that purpose or controlled by Russian state or business organizations in India, came second in those rankings with 24.77% of the total shipments, or 11.8 million tons. Shipowners from Turkey ranked third with 13.48% of the total shipments, or 6.4 million tons of Russian oil.

The 4th place is occupied by the companies registered under a flag of convenience (FOC), including mainly the Marshall Islands, Liberia, and Seychelles, totaling 12,43% or 5,9 million tons.

In Part 3 — Where Russian Crude Oil in the Black Sea Was Transported From During the EU and G7 Embargo (3) – we presented an analysis of the ports of departure for tankers carrying Russian crude oil over the period of EU/G7 embargo, ranking those as follows:

- Novorossiysk (RU NVS NOVOROSSIYSK) – 28, 277,340 tons, 59,46%

- Transshipment point (RU KAVKAZ SOUTH ANCH) located 15 nautical miles south of the Black Sea entrance to the Kerch Strait, i.e. outside the 12-mile zone between Ukraine and Russia – 7, 431,708 tons, 15,63%;

- Taman (RU TAM TAMAN) – 6, 285,003 tons, 13,21%;

- Tuapse (RU TUA TUAPSE) – 5, 566,767 tons, 11,70%

The next objective of our analysis was the destination countries:

1. Over the embargo duration — 05.12.2022-31.12.2023 — Russian crude oil was exported from the Black Sea ports to 28 countries totaling 47.5 million tons.

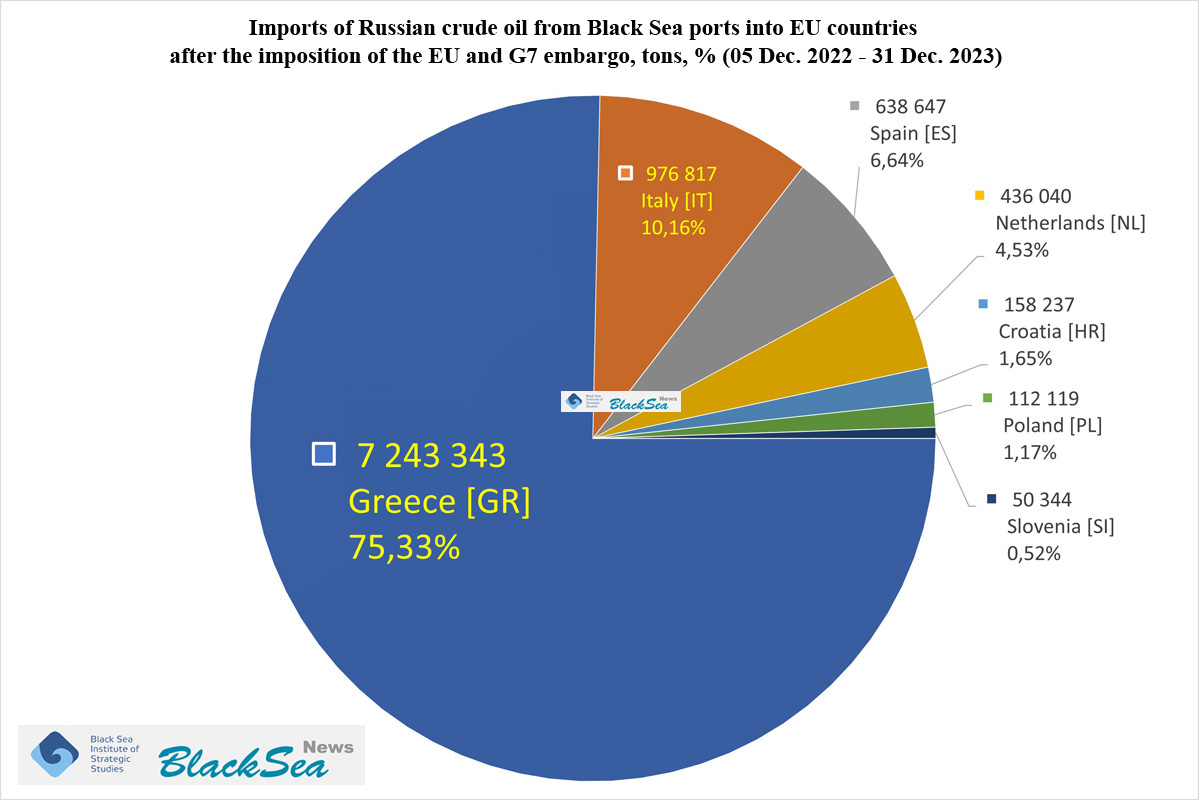

See the countries import volume ranking in Figure 1 on the right and Table 1 below.

The largest EU importer of Russian «Black Sea» crude oil over the embargo period is Greece.

The shares of the Laconian Gulf transshipment point and 2 Greek ports accounted for 7.2 million tons of Russian crude oil, or 75.33% of the volumes that entered the EU in violation of the embargo. Of these, 97.29% of all Greece-destined Russian crude oil arrived to the Laconian Gulf transshipment point

Table 1

| In total EU, tons, % | 9 615 547 | 100% |

| Greece [GR] | 7 243 343 | 75,33% |

| Italy [IT] | 976 817 | 10,16% |

| Spain [ES] | 638 647 | 6,64% |

| Netherlands [NL] | 436 040 | 4,53% |

| Croatia [HR] | 158 237 | 1,65% |

| Poland [PL] | 112 119 | 1,17% |

| Slovenia [SI] | 50 344 | 0,52% |

See the countries import volume ranking in Figure 2 on the right and Table 2 below.

Of all the non-EU countries, during the embargo, India became the largest importer of Russian crude oil with 38.90%, or 14.7 million tons, of all non-European volumes.

Table 2

| In total non-EU, tons, % | 37 945 271 | 100% |

| India [IN] | 14 762 530 | 38,90% |

| Singapore [SG] | 5 667 700 | 14,94% |

| China [CN] | 5 146 470 | 13,56% |

| Turkey [TR] | 5 089 857 | 13,41% |

| UAE [AE] | 2 720 908 | 7,17% |

| Saudi Arabia [SA] | 815 748 | 2,15% |

| Myanmar [MM] | 789 591 | 2,08% |

| Malaysia [MY] | 673 481 | 1,77% |

| Sri Lanka [LK] | 586 732 | 1,55& |

| Tunisia [TN] | 278 520 | 0,73% |

| Bahamas [BS] | 230 131 | 0,61% |

| Brazil [BR] | 211 031 | 0,56% |

| Korea [KR] | 163 750 | 0,43% |

| Russia [RU] | 160 159 | 0,42% |

| Senegal [SN] | 144 209 | 0,38% |

| Djibouti [DJ] | 109 841 | 0,29% |

| Ghana [GH] | 109 266 | 0,29% |

| Cuba [CU] | 74 581 | 0,20% |

| Oman [OM] | 74 269 | 0,20% |

| Indonesia [ID] | 71 498 | 0,19% |

| Togo [TG] | 64 999 | 0,17% |

3. For the overall ranking of the countries-importers, see Figure 3 and Table 3.

Greece is in 2nd place with 15.23%, Singapore — in 3rd with 11.92%, China — in 4th with 10.82%, Turkey — in 5th with 10.70%, and the UAE — in 6th place with 5.72%.

Table 3

| Countries, in total, tons, % | 47 560 818 | 100% |

| India [IN] | 14 762 530 | 31,04 |

| Greece [GR] | 7 243 343 | 15,23 |

| Singapore [SG] | 5 667 700 | 11,92 |

| China [CN] | 5 146 470 | 10,82 |

| Turkey [TR] | 5 089 857 | 10,70 |

| UAE [AE] | 2 720 908 | 5,72 |

| Italy [IT] | 976 817 | 2,05 |

| Saudi Arabia [SA] | 815 748 | 1,72 |

| Myanmar [MM] | 789 591 | 1,66 |

| Malaysia [MY] | 673 481 | 1,42 |

| Spain [ES] | 638 647 | 1,34 |

| Sri Lanka [LK] | 586 732 | 1,23 |

| Netherlands [NL] | 436 040 | 0,92 |

| Tunisia [TN] | 278 520 | 0,59 |

| Bahamas [BS] | 230 131 | 0,48 |

| Brazil [BR] | 211 031 | 0,44 |

| Korea [KR] | 163 750 | 0,34 |

| Russia [RU] | 160 159 | 0,34 |

| Croatia [HR] | 158 237 | 0,33 |

| Senegal [SN] | 144 209 | 0,30 |

| Poland [PL] | 112 119 | 0,24 |

| Djibouti [DJ] | 109 841 | 0,23 |

| Ghana [GH] | 109 266 | 0,23 |

| Cuba [CU] | 74 581 | 0,16 |

| Oman [OM] | 74 269 | 0,16 |

| Indonesia [ID] | 71 498 | 0,15 |

| Togo [TG] | 64 999 | 0,14 |

| Slovenia [SI] | 50 344 | 0,11 |

Important: The November-December 2023 decline in volumes is due exclusively to weather conditions in the Black Sea, namely, prolonged powerful storms off the Russian coast.

Table 4.

To be continued…

* * *

More on the topic

- 17.04.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of March 2025 Violations

- 16.04.2025 Russian Crude Oil Imports to the EU Embargo: Database of March 2025 Violations

- 15.04.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: March 2025 Database

- 19.03.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of February 2025 Violations

- 18.03.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of February 2025 Violations

- 12.03.2025 Russian Crude Oil Imports to the EU Embargo: Database of February 2025 Violations

- 11.03.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of February 2025 Violations

- 10.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: February 2025 Database

- 05.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: February 2025 Database

- 24.02.2025 Andriy Klymenko: «La “flotte fantôme russe“ est un mythe inventé par commodité»

- 22.02.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of January 2025 Violations

- 20.02.2025 Andrii Klymenko: "The Shadow Fleet and Price Ceiling are Myths Contrived by the US for its Own Convenience"