Exports of Russian Crude Oil from Black Sea Seaports Over the Period of the EU/G7 Embargo — December 5, 2022 - December 31, 2023 (1)

The Monitoring Group of BlackSeaNews and

the Black Sea Institute of Strategic Studies

The Monitoring Group of the Black Sea Institute of Strategic Studies and BlackSeaNews based on the results of its own monitoring (see Bloody Oil), presents below an analysis of Russian crude oil exports from Black Sea seaports over the period of the EU/G7 embargo — 12/05/2022 - 12/31/2023.

For reference: on December 5, 2022, the EU embargo on Russian marine oil imports (except for Bulgaria) came into force, leaving only pipeline deliveries available.

In addition, the EU, together with the US and the G7, introduced a mechanism of limiting the price of Russian oil supplied to those countries that were not part of the embargo. This mechanism consists of a ban on the provision of maritime services for the transportation of Russian oil to third countries and insurance of such cargoes if its price exceeds a certain ceiling, i.e., price cap. The price cap has been set at $60 per barrel.

The purpose of the scheme was to reduce Russia's revenues from energy exports, while avoiding an oil price hike if the interruption of supplies led to a temporary fuel shortage on the world market.

* * *

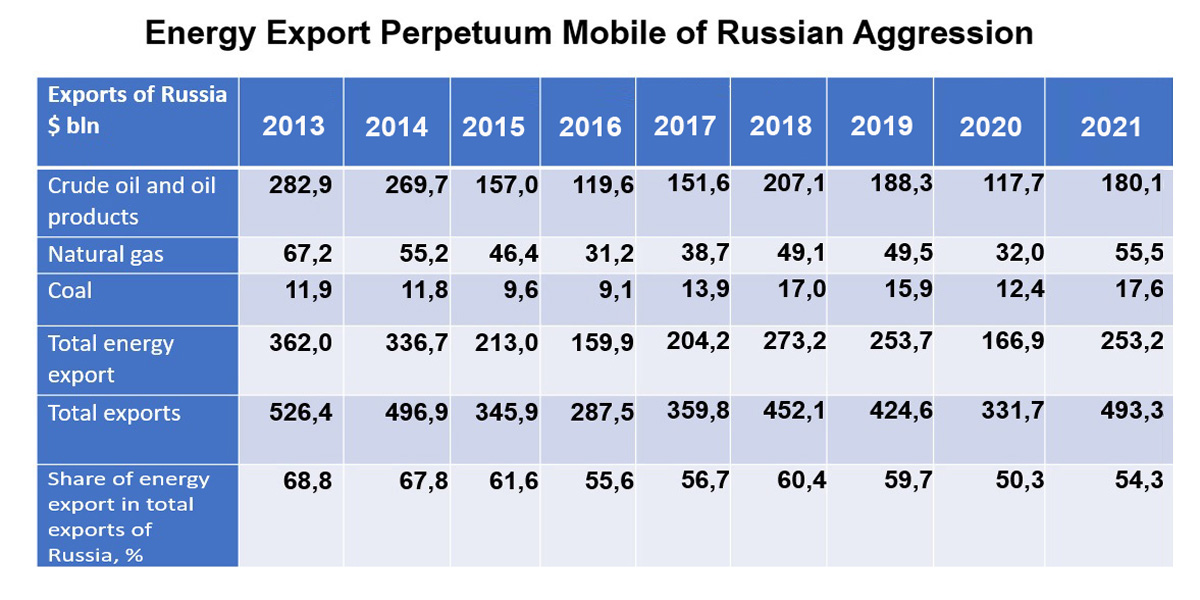

The monitoring and a corresponding adequate reaction to its results are crucial, as energy exports account for well over half of Russia's export earnings: depending on world prices, between 2013-2021, i.e., when Russian statistics could still be tentatively trustworthy, according to the Center for Global Studies «Strategy XXI,» its share ranged from 54.3% to 68.8%.

The monitoring and a corresponding adequate reaction to its results are crucial, as energy exports account for well over half of Russia's export earnings: depending on world prices, between 2013-2021, i.e., when Russian statistics could still be tentatively trustworthy, according to the Center for Global Studies «Strategy XXI,» its share ranged from 54.3% to 68.8%.

It’s worth keeping in mind that in the structure of revenues from Russian energy exports, the first place by a large margin belongs not to the natural gas, but to crude oil and petroleum products: 71.13% in 2021, while the share of revenues from gas and coal exports in that year was only 21.92% and 6.95%, respectively.

Given that after the outbreak of the Great War in 2022, Russian natural gas exports largely lost their main market in Europe, that is largely irreplaceable, it can be assumed that the share of oil and oil products now exceeds 70%.

Revenues from energy exports are the largest external source of funding Russia's military spending, including the purchase of military equipment and dual-use goods abroad. That is, the trends in the export of Russian crude oil and petroleum products are one of the key indicators of the further war duration.

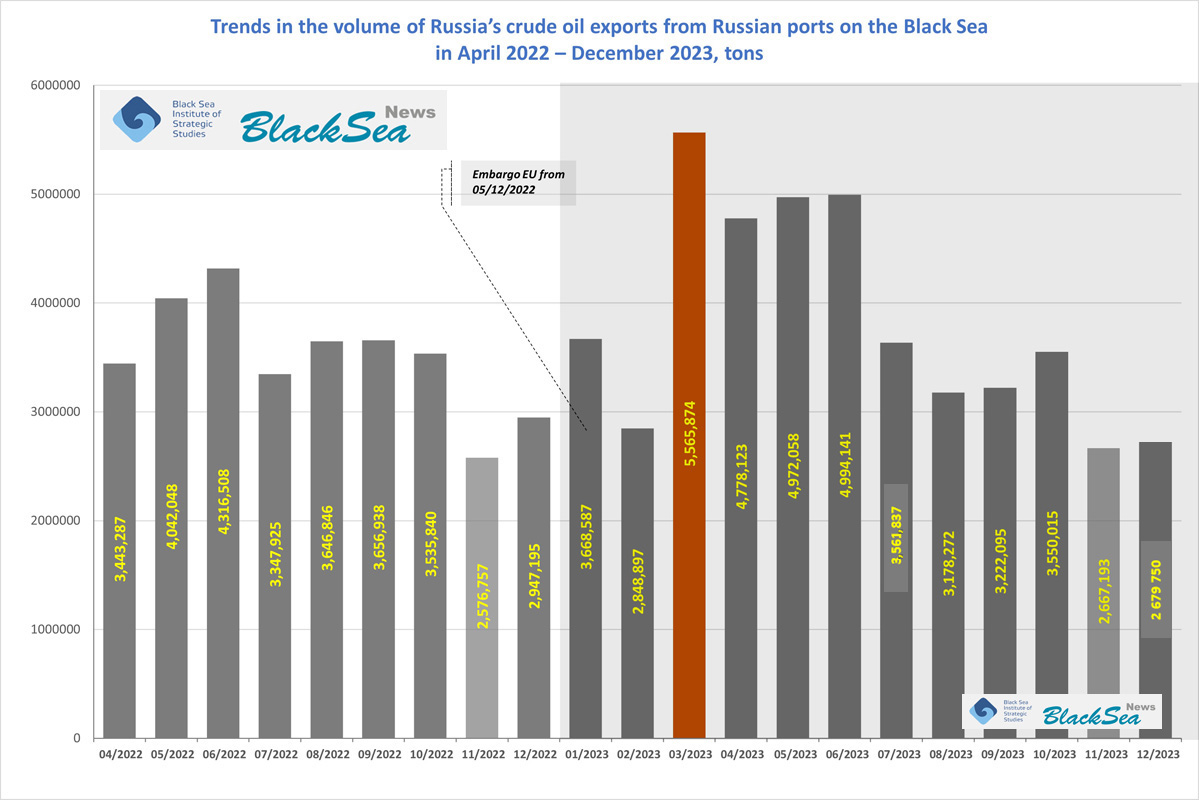

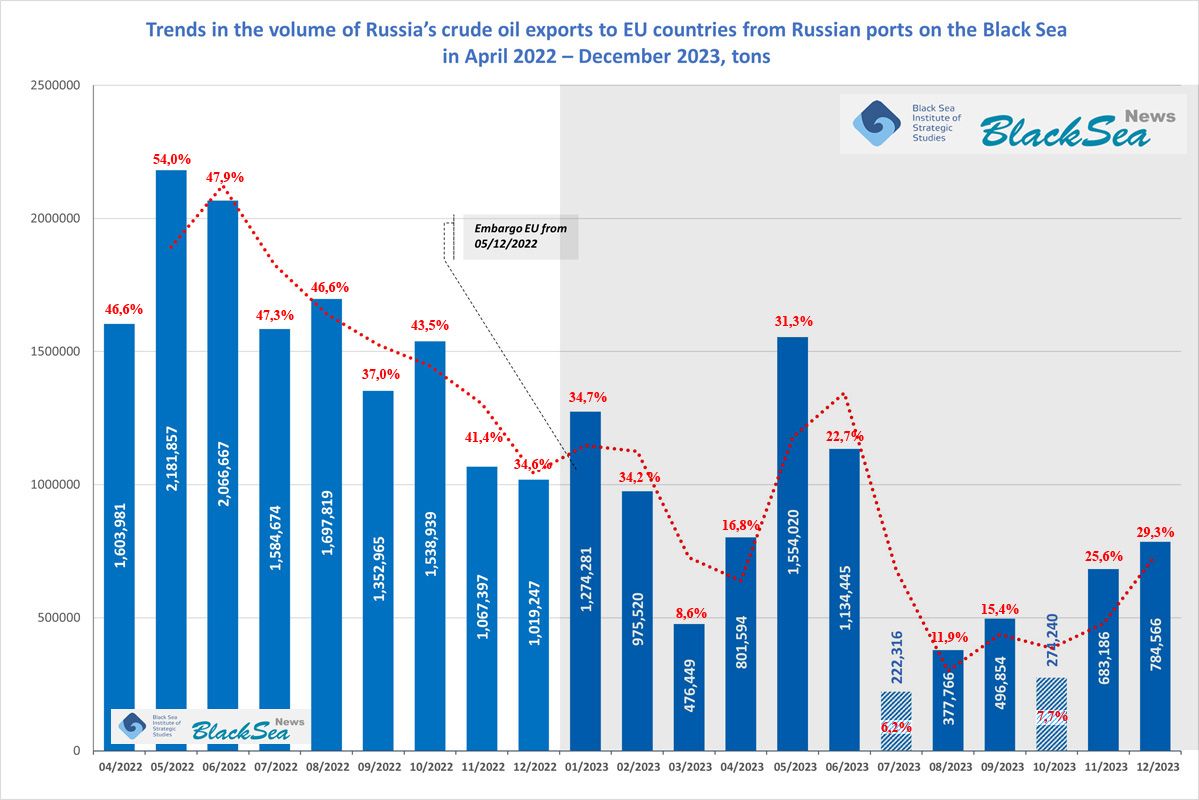

In total, since the December 05, 2022 start of the EU embargo, as of December 31, 2023, 47.5 million tons of Russian crude oil have been exported from Russia's ports Black Sea to various countries (Figure 1, excluding exports to Bulgaria and raid transshipment near Romania).

In total, since the December 05, 2022 start of the EU embargo, as of December 31, 2023, 47.5 million tons of Russian crude oil have been exported from Russia's ports Black Sea to various countries (Figure 1, excluding exports to Bulgaria and raid transshipment near Romania).

Overall, the amount of Russian oil on the market over that time has hardly changed: before the embargo, in April-December 2022, the monthly average of crude oil Black Sea export was 3.57 million tons, while in January-December 2023 — 3.52 million tons.

The November-December 2023 exports decline so far, looks like merely a seasonal one, caused by powerful storms in the Black Sea in those months. Whether or not that’s the case will become clear in a few months.

However, in a year’s time, the embargo on Russian crude oil imports to the EU has yet to be fully ensured.

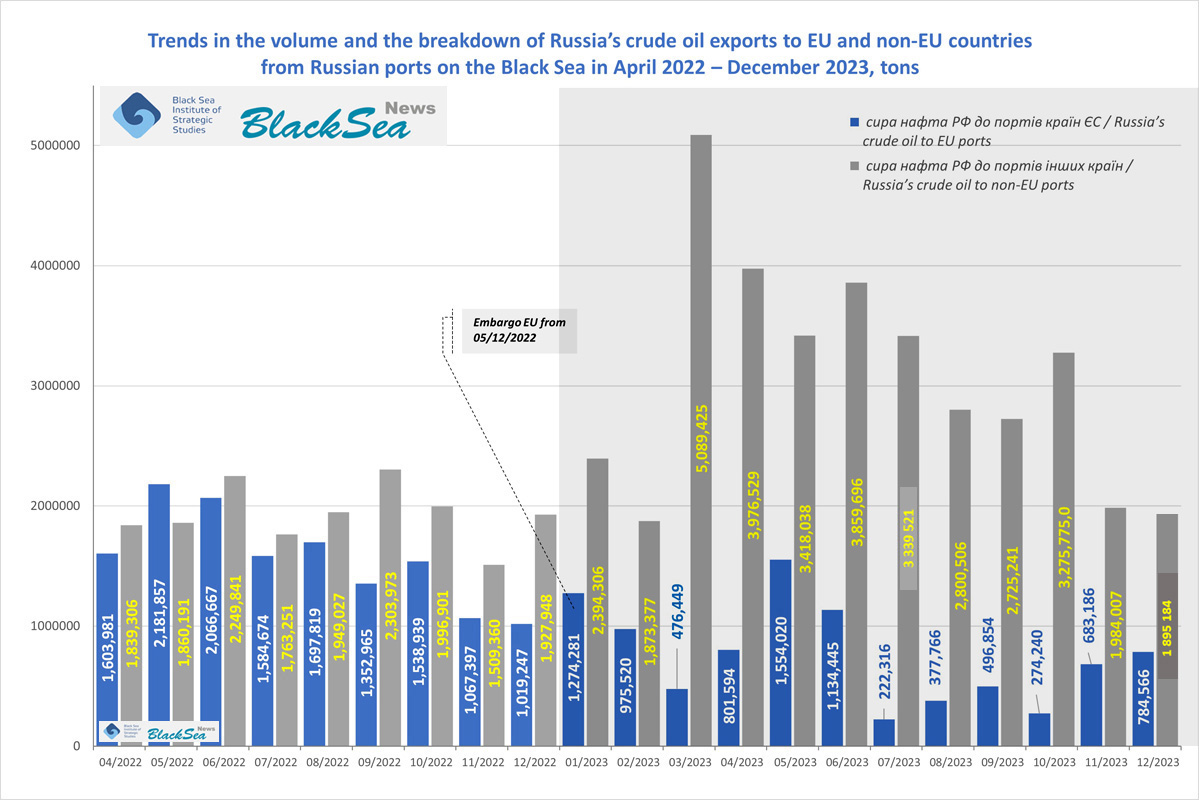

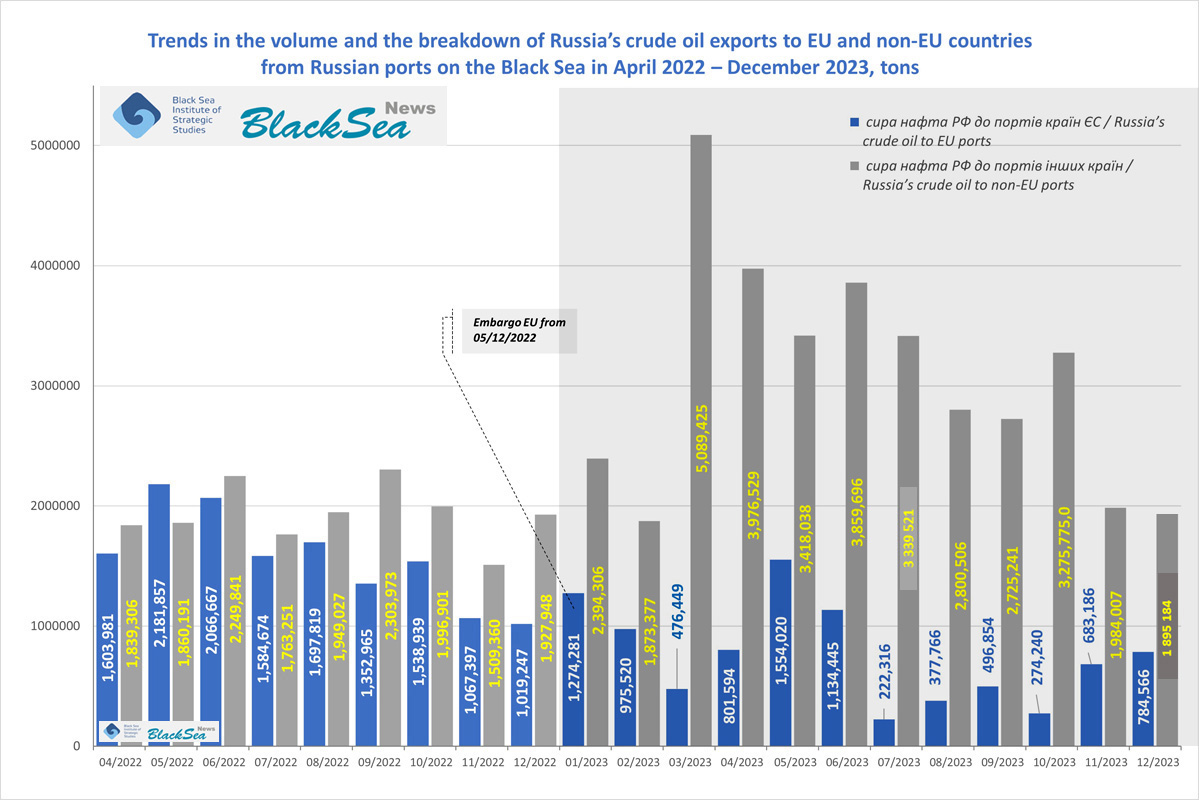

Over the course of the embargo year, 9.6 million tons — or 20.22% of total crude oil exports — have been exported from Russia’s Black Sea to EU ports and transshipment terminals off the EU countries coasts. At the same time, 37.9 million tons — or 79.78% — have been exported to other countries (Figure 2).

Over the course of the embargo year, 9.6 million tons — or 20.22% of total crude oil exports — have been exported from Russia’s Black Sea to EU ports and transshipment terminals off the EU countries coasts. At the same time, 37.9 million tons — or 79.78% — have been exported to other countries (Figure 2).

This means that the current level of embargo compliance is about 80%.

A detailed overview of the embargo violations will be published separately.

It’s worth noting that before the EU's official June 2022 announcement on the embargo enforcement in six months, in April and May 2022, the EU countries had imported 46.6% and 53.9% of Russian oil from Black Sea ports, respectively, or at least half. Shortly after, Russia started the reorientation of its marine oil exports to other markets.

As clearly seen in Figure 3, the monthly share of EU ports in Russia’s Black Sea crude oil exports shows a downward trend, although with significant fluctuations.

As clearly seen in Figure 3, the monthly share of EU ports in Russia’s Black Sea crude oil exports shows a downward trend, although with significant fluctuations.

In March, July, and October 2023, the minimum share of EU countries in Russian oil imports was recorded at 6-8%, but that has not become a rule.

We believe that the nature of those fluctuations is related not to the effectiveness of the embargo compliance control, but rather to the fears of the regional maritime carriers regarding the possible EU and US sanctions against the shipowning companies.

Disclaimer: the purpose of this report is not to analyze world oil prices or compliance with the price cap in the first year of the embargo, especially since investigations by the world's leading news agencies have repeatedly demonstrated that the price cap has not been complied with, and that compliance monitoring of the oil exports to Asian and African countries is effectively impossible.

In the next parts, we will publish answers to other, no less pressing questions, namely:

• who transported Russian «blood oil» in the first year of the embargo

• what ports that oil was shipped from and to.

So, stay tuned, it gets interesting…

* * *

This article has been prepared with the support of the European Union in Ukraine. The content of the article is the sole responsibility of the authors and does not necessarily reflect the position of the EU

This article has been prepared with the support of the European Union in Ukraine. The content of the article is the sole responsibility of the authors and does not necessarily reflect the position of the EU

More on the topic

- 17.04.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of March 2025 Violations

- 16.04.2025 Russian Crude Oil Imports to the EU Embargo: Database of March 2025 Violations

- 15.04.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: March 2025 Database

- 14.04.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of March 2025 Violations

- 11.04.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of March 2025 Violations

- 10.04.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: March 2025 Database

- 19.03.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of February 2025 Violations

- 18.03.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of February 2025 Violations

- 12.03.2025 Russian Crude Oil Imports to the EU Embargo: Database of February 2025 Violations

- 11.03.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of February 2025 Violations

- 10.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: February 2025 Database

- 05.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: February 2025 Database