Who transported Russian crude oil from Black Sea ports after the EU and G7 embargo was imposed (2)

The Monitoring Group of BlackSeaNews and

the Black Sea Institute of Strategic Studies

The Monitoring Group of the Black Sea Institute of Strategic Studies and BlackSeaNews, based on the results of its own monitoring (see Russian Blood-Soaked Export), publishes an analysis of companies transporting Russian crude oil from Black Sea ports during the period from 05 December 2022 – when the EU and G7 embargo was imposed – to 31 December 2023.

For reference. We would like to remind you that on 5 December 2022, the EU ban on the seaborne import of Russian crude oil (except into Bulgaria) came into force. Only pipeline deliveries remained available.

In addition to the embargo, the EU, together with the USA and the G7, introduced a price cap on Russian oil supplied to countries that had not joined the sanctions. This mechanism consists in the prohibition of providing maritime or insurance services for the transportation of Russian oil to third countries if the price of such cargo exceeds a certain cap. The EU has imposed the price cap at $60 per barrel.

The purpose of this scheme was to reduce Russia's income from the export of energy resources and at the same time avoid an increase in oil prices if the cessation of supplies leads to a temporary shortage of fuel on the world market.

* * *

In the first part of this report – Exports of Russian crude oil from Black Sea seaports over the period of the EU/G7 Embargo — 5 December 2022 - 31 December 2023 (1) – we stated that during that period, 47.5 million tons of Russian crude oil were exported from Russia’s ports on the Black Sea to various countries around the world.

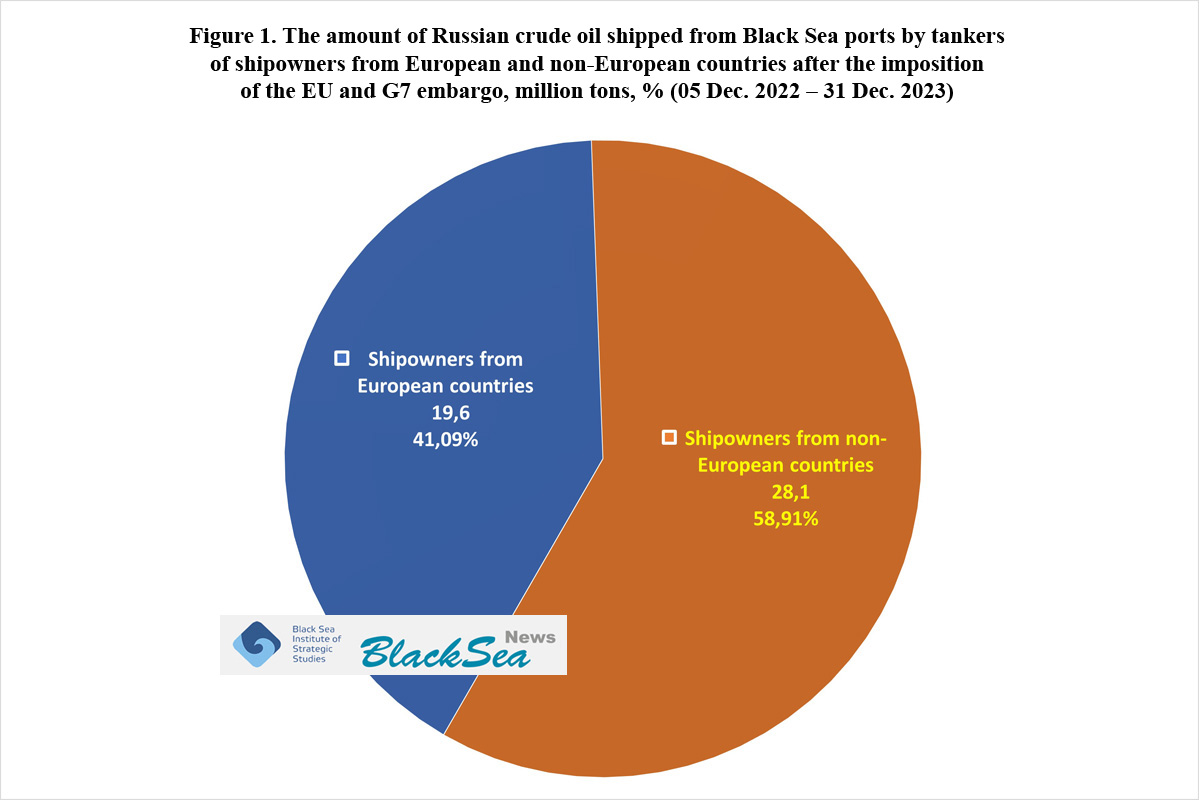

Of these 47.5 million tons of Russian crude oil, 19.6 million tons (41.09%) were transported by shipowners from European countries (see Figure 1).

Of these 47.5 million tons of Russian crude oil, 19.6 million tons (41.09%) were transported by shipowners from European countries (see Figure 1).

Russia’s crude oil was shipped both to EU countries (to ports and transshipment points) in violation of the embargo and to other countries around the world, which hadn’t imposed the embargo. Theoretically, the price cap should have prevented EU companies from providing transport or insurance services for the shipment of Russian oil to third countries above the cap.

The remaining 28.1 million tons of Russian oil, or 58.91%, were transported by shipowners from countries that hadn’t imposed sanctions against Russia, as well as from Russia itself. In this case, it was almost pointless to even talk about a price cap.

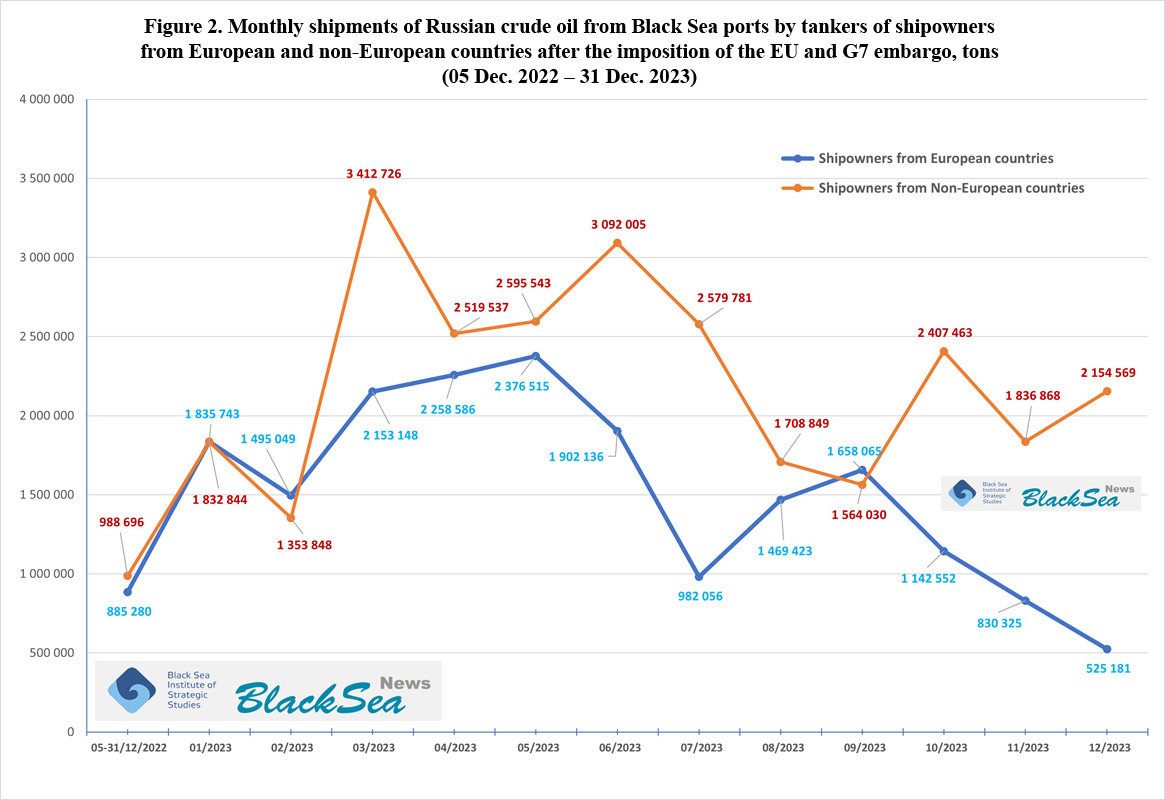

In the first three months after the embargo was placed (December 2022 – February 2023), shipowners from European and non-European countries transported almost the same amount of Russian crude oil. However, from March 2023, the amount of Russian crude oil transported by shipowners from non-European countries increased significantly (see Figure 2).

In the first three months after the embargo was placed (December 2022 – February 2023), shipowners from European and non-European countries transported almost the same amount of Russian crude oil. However, from March 2023, the amount of Russian crude oil transported by shipowners from non-European countries increased significantly (see Figure 2).

This trend continued until the end of 2023, with the exception of September 2023, when the amounts transported by European and non-European shipowners were almost equal again.

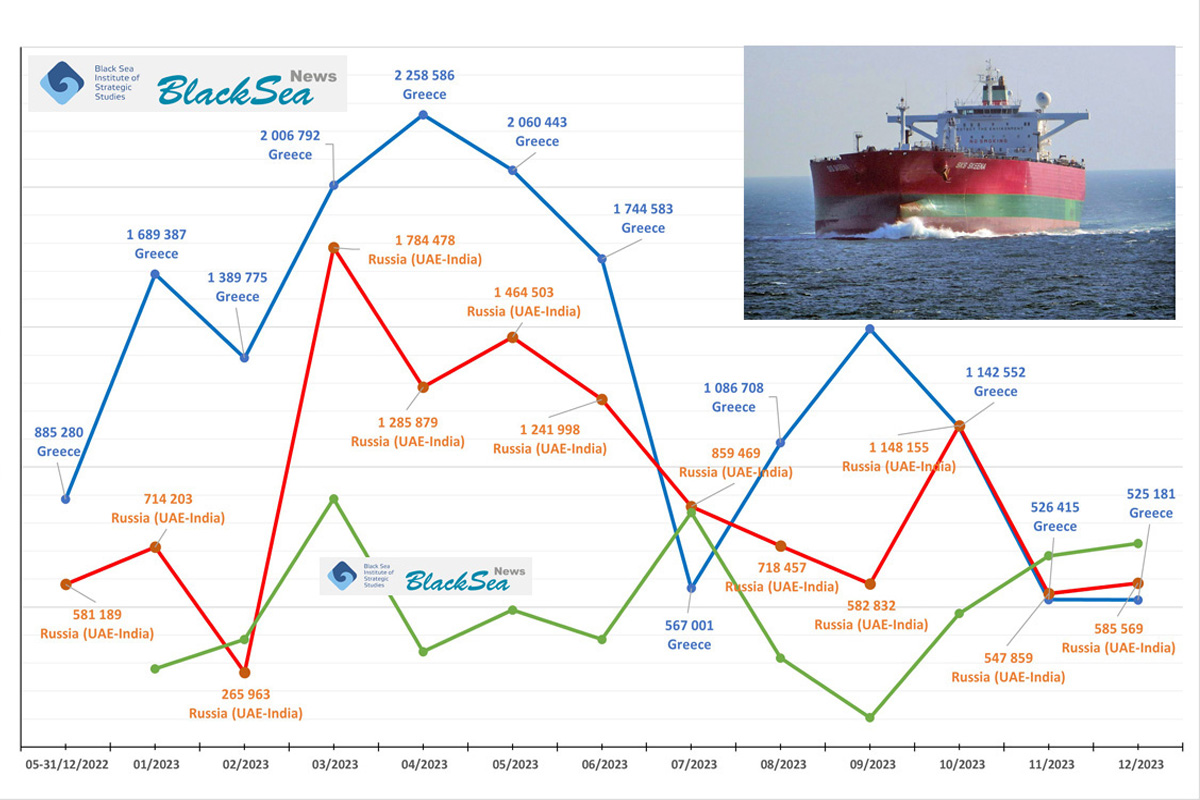

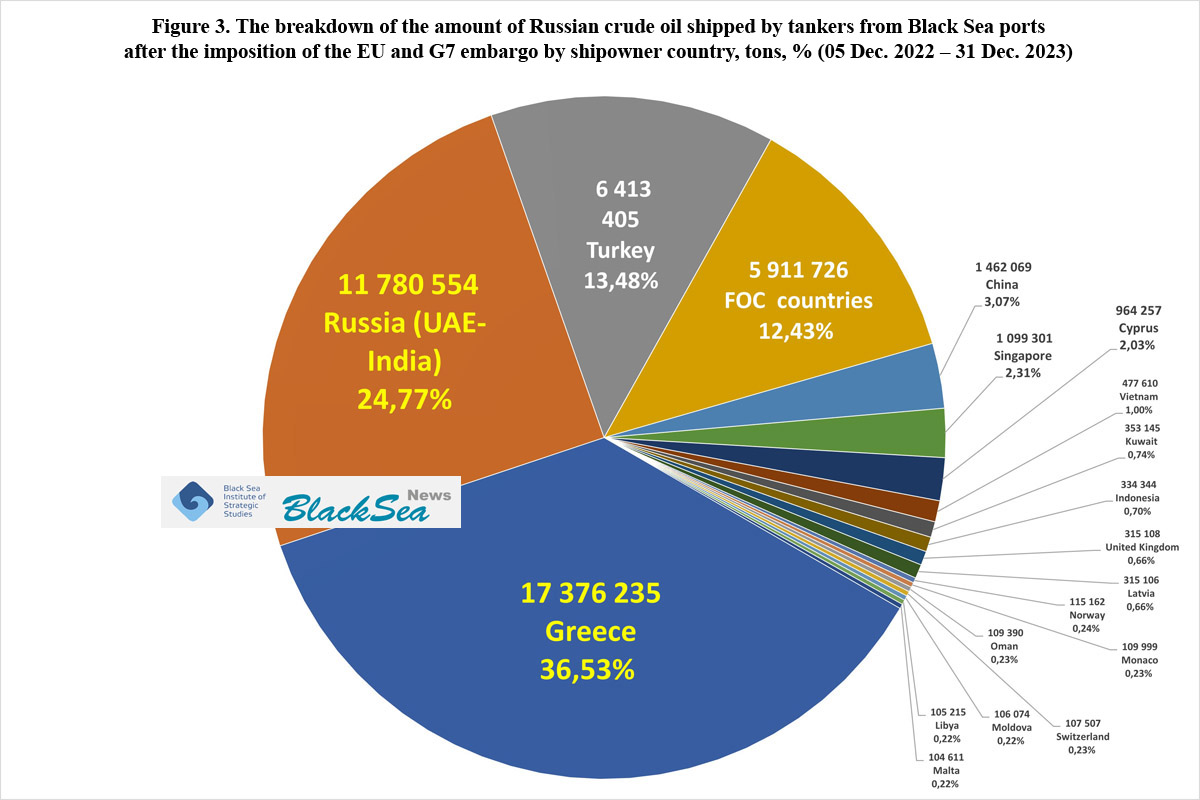

Overall, for the entire period from 05 Dec. 2022 to 31 Dec. 2023, Greek shipowners transported the largest amount of Russian crude oil – 36.53% of total shipments, or 17.4 million tons (see Figure 3).

Overall, for the entire period from 05 Dec. 2022 to 31 Dec. 2023, Greek shipowners transported the largest amount of Russian crude oil – 36.53% of total shipments, or 17.4 million tons (see Figure 3).

Russian companies, including those registered or re-registered in the UAE and created for that purpose or controlled by Russian state or business organisations in India, came second in these “rankings” with 24.77% of total shipments, or 11.8 million tons.

Shipowners from Turkey ranked third with 13.48% of total shipments, or 6.4 million tons of Russian oil.

Companies registered in flag-of-convenience (FOC) countries ranked fourth. These included mainly the Marshall Islands, Liberia, and Seychelles (see FOC countries in Figure 3).

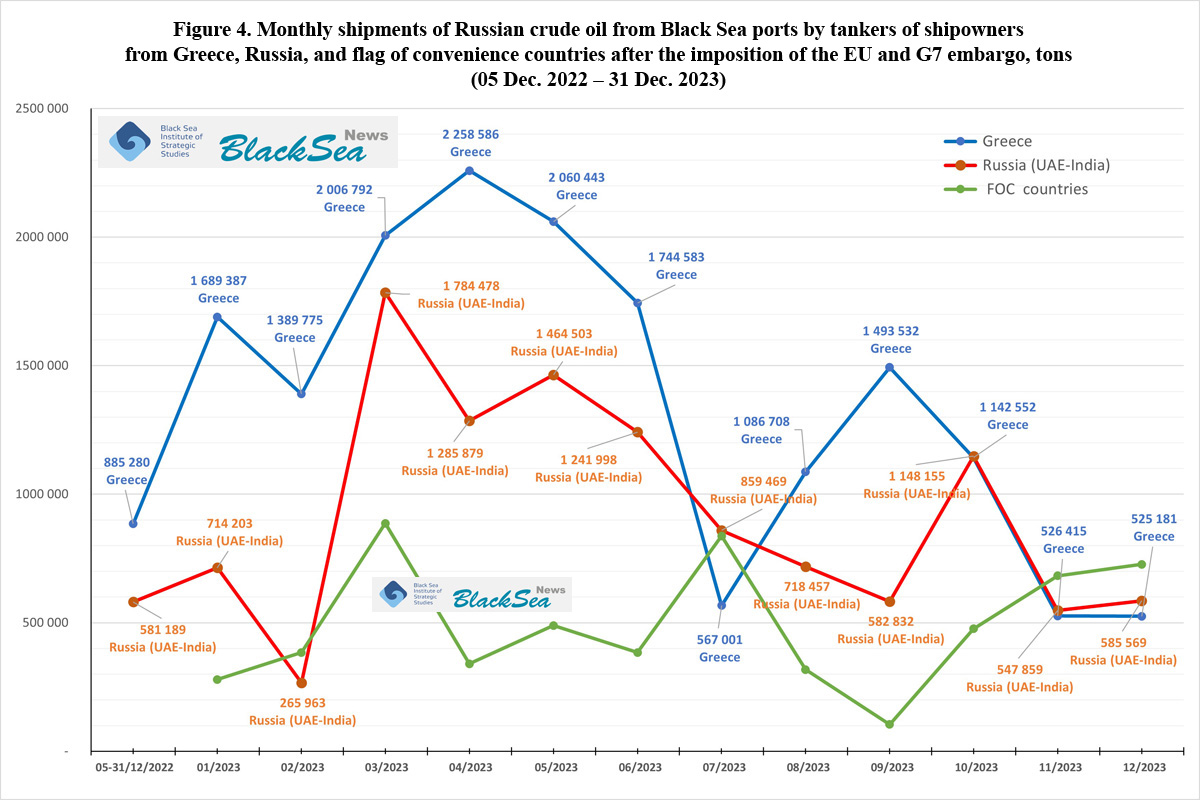

The monthly "rankings" of the main groups of companies transporting Russian oil indicate certain processes and trends (see Figure 4).

The monthly "rankings" of the main groups of companies transporting Russian oil indicate certain processes and trends (see Figure 4).

After the approval of the 11th package of EU sanctions against Russia on 21 June 2023, which prohibited transshipment of Russian oil and petroleum products, including that with AIS transponders turned off, the Ukrainian National Agency on Corruption Prevention (NACP) listed five Greek shipping companies transporting Russian oil and petroleum products as “international sponsors of war”: Dynacom Tankers Management (DTM), Delta Tankers LTD, Thenamaris Ships Management Inc., Minerva Marine, and TMC Tankers LTD.

After that, in July 2023, there was a decrease in quantities of Russian crude oil shipped by tankers of Greek companies. However, in August and September 2023, they began to increase again.

Therefore, the NACP reinstated the five Greek shipping companies as "International sponsors of war,” because, according to the NACP, these companies had not complied with the conditions agreed during the negotiations on their exclusion from the list. During the talks, the Ukrainian side suggested that the companies should: stop the practice of turning off transponders (devices tracking ship navigation); stop the practice of transshipment of cargo from board to board; and publicly condemn Russian aggression.

Later, in December 2023, the quantities of Russian oil shipped by tankers of Greek companies were at the lowest level since the embargo and the price cap were imposed.

As of the time of publication, the status of Dynacom Tankers Management (DTM) and Delta Tankers LTD as “international sponsors of war” is “SUSPENDED for the period of bilateral consultations involving representatives of the European Commission.” Thenamaris Ships Management Inc., Minerva Marine, and TMC Tankers LTD are not currently listed as sponsors of war.

Against this background, it would be logical to expect further replacement of Greek companies’ tankers with vessels belonging to shipowners from flag-of-convenience countries or Russia, including those registered or re-registered in the UAE and India.

At the end of 2023, there was a hint of this emerging trend, but due to stormy weather in November and December 2023, which affected the loading of oil in Russian Black Sea ports, we will see it later.

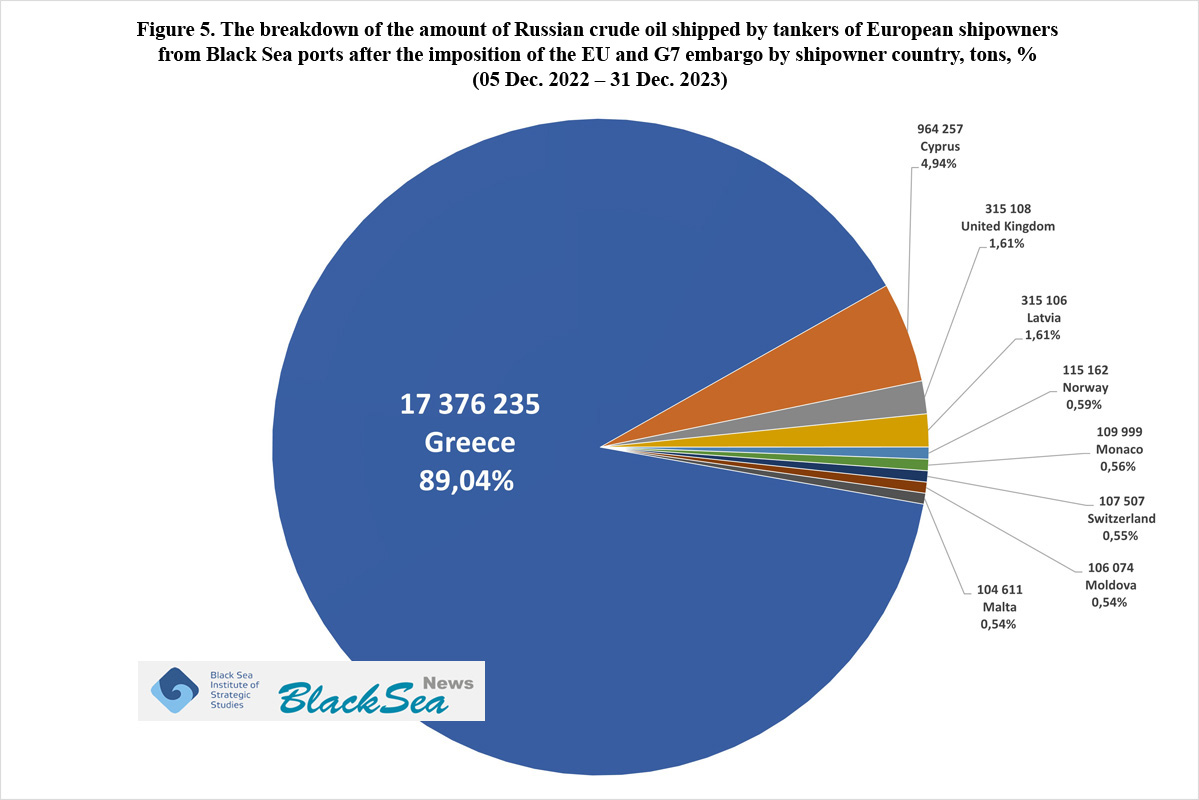

The proportion of shipowners from other European countries, except Greece, appears insignificant (see Figure 5).

The proportion of shipowners from other European countries, except Greece, appears insignificant (see Figure 5).

Whereas Greek companies’ tankers account for 89.04% of the total volume of Russian crude oil shipped by European countries from Black Sea ports (17.4 million tons), about 5% was transported by tankers belonging to shipping companies from Cyprus; from 1.6 to 0.5% – by vessels of shipowners from Great Britain, Latvia, Norway, Monaco, Switzerland, and Moldova.

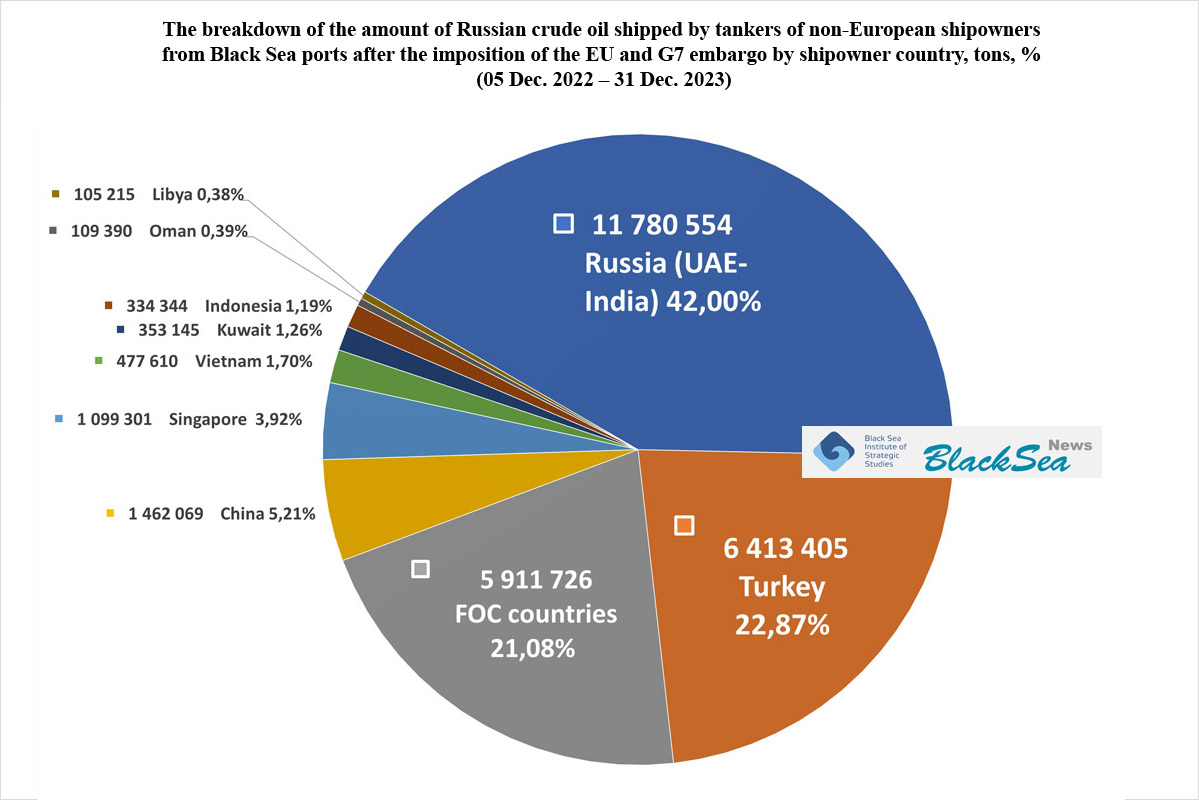

Among non-European countries whose shipowners transported Russian oil in 2023 after the imposition of the G7 and EU embargo, Russia, including ship-owning companies under its control in the UAE and India, was the undisputed leader (see Figure 6).

Among non-European countries whose shipowners transported Russian oil in 2023 after the imposition of the G7 and EU embargo, Russia, including ship-owning companies under its control in the UAE and India, was the undisputed leader (see Figure 6).

Tankers of Russian shipowners transported 42% of oil, followed by those from Turkey with almost 23%, and flag-of-convenience (FOC) countries – with 21%.

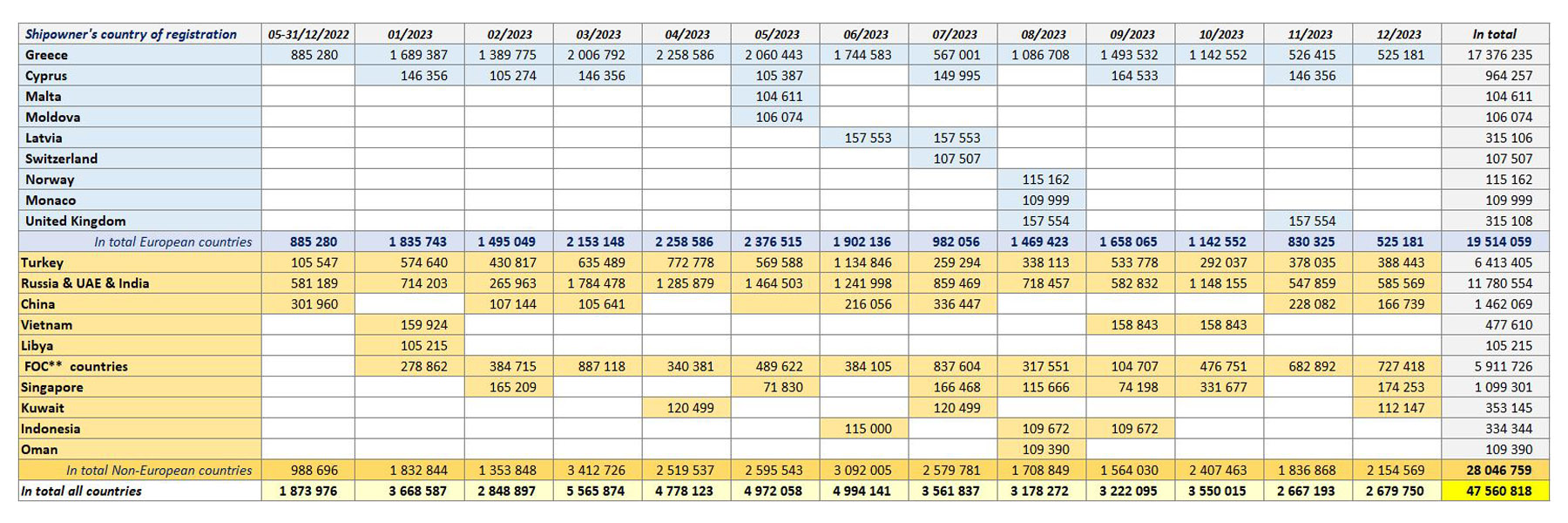

The breakdown of the amount of Russian crude oil shipped from Black Sea ports from 05 Dec. 2022 to 31 Dec. 2023 by country of registration of shipping companies (the owners and operators of tankers) is given in the table below.

To be continued...

* * *

This article has been prepared with the support of the European Union in Ukraine. The content of the article is the sole responsibility of the authors and does not necessarily reflect the position of the EU

This article has been prepared with the support of the European Union in Ukraine. The content of the article is the sole responsibility of the authors and does not necessarily reflect the position of the EU

More on the topic

- 24.02.2025 Andriy Klymenko: «La “flotte fantôme russe“ est un mythe inventé par commodité»

- 22.02.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of January 2025 Violations

- 20.02.2025 Andrii Klymenko: "The Shadow Fleet and Price Ceiling are Myths Contrived by the US for its Own Convenience"

- 10.02.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of January 2025 Violations

- 21.01.2025 The Problem of Assessing Russia's Economic Capacity to Wage War Under Sanctions. Part 6

- 21.01.2025 Ukrainian Black Sea Corridor as Russia's Key Military Target. Part 5

- 17.01.2025 Russia is developing a new strategy to increase security risks in the Black Sea in response to the defeat of the Black Sea Fleet. Part 4

- 15.01.2025 Russia's Ways of Raising the World Oil Prices. Part 3

- 14.01.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of December 2024 Violations

- 13.01.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of December 2024 Violations

- 10.01.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Baltic Sea Ports: December 2024 Database

- 31.12.2024 Ways to Reduce Russia's Revenues from Seaborne Crude Oil and Petroleum Products Exports. Part 2