Russia's Ways of Raising the World Oil Prices. Part 3

The Monitoring Group of BlackSeaNews

and the Black Sea Institute of Strategic Studies

presents Part 3 of the Report on European security risks and forecasts as of late 2024 – early 2025, based on the monitoring results of the Black Sea Institute of Strategic Studies, Ukraine.

European Security Risks and Forecasts as of Early 2025. Part 1

Ways to Reduce Russia's Revenues from Seaborne Crude Oil and Petroleum Products Exports. Part 2

* * *

The difficulty of restricting Russia's Baltic maritime oil exports will be exacerbated by its geopolitical game to increase world oil prices.

As far as we know, Russia has already begun taking measures to raise global oil prices, as the downward trend is utterly unacceptable for the aggressor state waging the war.

While in August 2024 we did not record any tankers heading east from Russian Baltic ports around Africa, bypassing the Suez Canal and the Red Sea, in September there were already 7 such cases, and in October – 13 ones.

Those coincided with the first world media reports in September on Russia's possible transfer of anti-ship missiles to Houthi extremists for firing at ships in the Red Sea.

For reference: the route to India, Singapore or China around Africa is 12-14 days longer and, accordingly, much more expensive than through the Suez Canal and the Red Sea (For the list of tankers/shipowners that have chosen that route, see Appendix 2).

So, we believe that the Russian aggressors order their Houthi accomplices to carry out a series of powerful attacks on tankers in the Red Sea, carefully timed to create panic on stock exchanges, thus, increasing world oil prices.

At the same time, Russia leaks information on the upcoming attacks to “friendly” owners of the tankers sailing from its Baltic Sea ports to India, Singapore, and China, which accounts for their growing number of voyages around Africa.

Moreover, Russia has another opportunity to drive up world oil prices. At present, there are two separate streams of crude oil exported from Russia’s Black Sea ports:

(1) Russian crude oil that is subject to EU and G7 embargo — from the ports of Novorossiysk, Taman, Tuapse, and the Kerch Strait transshipment point.

(2) Kazakh crude oil of the Caspian Pipeline Consortium (CPC) that is not subject to any sanctions — from a special terminal in the port of Novorossiysk, from where it gets onto tankers via three special single buoy moorings, which allow tankers to be loaded at a considerable distance from the shore.

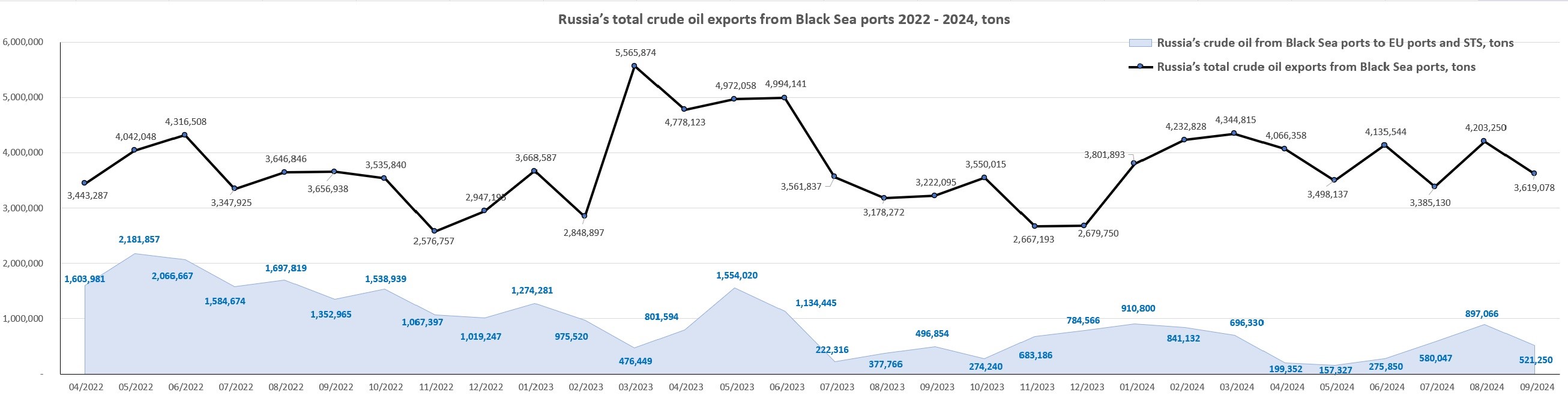

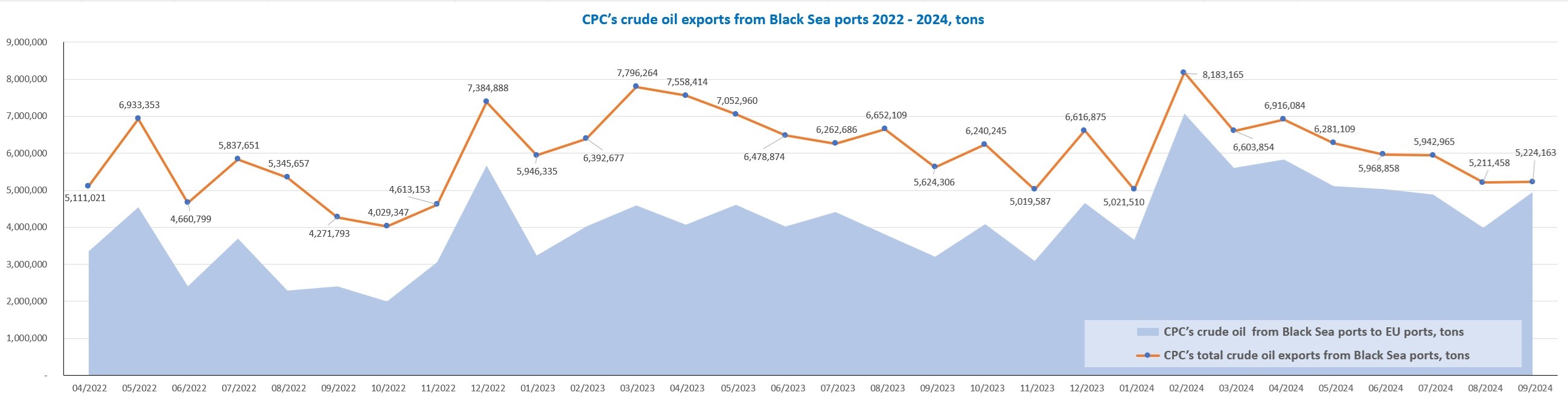

Since the start of the embargo, EU states have replaced Russian crude oil exported from Black Sea ports with Kazakh CPC oil (see Figure 1 and Figure 2).

Note that EU countries import almost all of Kazakhstan's CPC oil (according to monitoring data, 94.9% of CPC oil was exported to the EU in September 2024).

Obviously, that creates opportunities for Russia to suspend or completely stop the export of Kazakh oil to the EU at any time and for any period under any pretext such as weather conditions, technical malfunctions, requirements of the Russian environmental services, or court decisions. Russia already resorted to such measures in March and July 2022.

According to our monitoring, over the period of the EU embargo on Russian seaborne oil imports, (December 2022-September 2024), the volume of Kazakh CPС oil imported by EU countries from the Black Sea totalled 100 million tons, or an average of 4.5 million tons per month.

The main importers of that oil, and thus the EU states that would be the most vulnerable to the Russian blackmail, are Italy, which imported 45% of CPC oil in September 2024, the Netherlands, Greece, France, and Spain with a share of 10-15% each.

Therefore, measures to limit Russia's maritime oil exports should be implemented gradually and in coordination with partners such as the US and other countries that intend to increase their share of the global energy market.

In view of Russia's ongoing aggressive war against Ukraine and Ukrainian resistance that will show no signs of abating, our recommendation to EU countries would be to get rid of the energy import flows that pass through the war zones. In that regard, Kazakhstan's current intentions to reorient a significant share of its oil to the Baku-Tbilisi-Ceyhan route are timely, even though they will certainly face Russian resistance.

Table 1. The List of Tankers that, on Their Way from Russian Baltic Sea Ports to Asia, Chose the Route Around Africa Instead of the Suez Canal and the Red Sea in September-October 2024

|

Name |

IMO |

DWT |

Flag |

Year built |

Port of departure |

Actual Time of Departure |

Port of destination |

Estimated Time of Arrival |

Registered owner |

|

SIKINOS I Crude Oil Tanker |

9800269 |

157007 |

Liberia |

2018 |

RU ULU |

2024-09-01 11:39 (UTC+3) |

IN SIK around Africa |

2024-10-12 16:00 (UTC+5) |

Registered owner GABI SHIPPING LTD 94, Poseidonos Avenue & 2, Nikis Street, Glyfada, 166 75, Athens, Greece.Ship manager/Commercial manager DYNACOM TANKERS MANAGEMENT LTD 94, Poseidonos Avenue & 2, Nikis Street, Glyfada, 166 75, Athens, Greece. |

|

ON PEACE Crude Oil Tanker |

9893204 |

115157 |

Panama |

2021 |

RU ULU |

2024-09-03 17:48 (UTC+3) |

SG SIN around Africa |

2024-10-18 08:01 (UTC+8) |

Registered owner ONEX PEACE INC C/O: Onex DMCC Unit 30-01-960, 1st Floor, Building 3, Dubai Multi Commodities Centre (DMCC), PO Box 488242, Dubai, United Arab Emirates.Ship manager/Commercial manager ONEX DMCC Unit 30-01-960, 1st Floor, Building 3, Dubai Multi Commodities Centre (DMCC), PO Box 488242, Dubai, United Arab Emirates. |

|

ON PRECIOUS Crude Oil Tanker |

9893216 |

114623 |

Panama |

2021 |

RU ULU |

2024-09-10 10:57 (UTC+3) |

SG SIN around Africa |

2024-10-25 16:00 (UTC+8) |

Registered owner ONEX PRECIOUS INC C/O: Onex DMCC Unit 30-01-960, 1st Floor, Building 3, Dubai Multi Commodities Centre (DMCC), PO Box 488242, Dubai, United Arab Emirates.Ship manager/Commercial manager ONEX DMCC Unit 30-01-960, 1st Floor, Building 3, Dubai Multi Commodities Centre (DMCC), PO Box 488242, Dubai, United Arab Emirates. |

|

EVAGORAS Crude Oil Tanker |

9239484 |

165209 |

Panama |

2003 |

RU ULU |

2024-09-11 12:00 (UTC+3) |

IN SIK around Africa |

2024-10-26 16:30 (UTC+5) |

Registered owner EVAGORAS SHIPPING CO LTD C/O: FML Ship Management Ltd Office 601, Ghinis Building, 58-60, Digeni Akrita Avenue, 1061, Nicosia, Cyprus. Ship manager/Commercial manager FML SHIP MANAGEMENT LTD Office 601, Ghinis Building, 58-60, Digeni Akrita Avenue, 1061, Nicosia, Cyprus.ISM Manager FLEET MANAGEMENT MIDDLE EAST Unit 1801, Reef Tower, Plot JLT-PH2-O1A, Jumeirah Lakes Towers, Dubai, United Arab Emirates. |

|

CAPTAIN PARIS Crude Oil Tanker |

9692844 |

113876 |

Malta |

2014 |

RU ULU |

2024-09-13 17:05 (UTC+3) |

SG SIN Around Africa

|

2024-10-31 10:00 (UTC+8) |

Registered owner ERGOLAS HOLDINGS INC C/O: Latsco Marine Management Inc (LMM) 4, Xenias Street, Kifisia, 145 62, Athens, Greece. Ship manager/Commercial manager LATSCO MARINE MANAGEMENT INC 4, Xenias Street, Kifisia, 145 62, Athens, Greece. |

|

BREEZE Crude Oil Tanker |

9809356 |

156682 |

Panama |

2018 |

RU ULU |

2024-09-21 23:52 (UTC+3) |

SG SIN around Africa |

2024-11-04 20:00 (UTC+8) |

Registered owner ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait.Ship manager/Commercial manager ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait. |

|

BUDDHA Crude Oil Tanker |

9283306 |

109637 |

Antigua and Barbuda |

2004 |

RU ULU |

2024-09-28 00:46 (UTC+3) |

IN SIK around Africa |

2024-11-11 11:30 (UTC+5) |

Registered owner SEASAILOR HOLDINGS LTD Saint John's, Antigua & Barbuda.Ship manager/Commercial manager SEASAILOR HOLDINGS LTD Saint John's, Antigua & Barbuda.ISM Manager BLUEJOURNEY SHIPPING LTD Nazan Sokak 2/6, Evliya Celebi Mah, Tuzla, 34944, Istanbul, Turkey. |

|

STAR ENERGY Crude Oil Tanker |

9773935 |

158409 |

Panama |

2016 |

RU ULU |

2024-10-01 11:00 (UTC+3) |

SG SIN Around Africa

|

2024-11-16 21:00 (UTC+8) |

Registered owner ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait.Ship manager/Commercial manager ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait. |

|

PANDA Crude Oil Tanker |

9284582 |

105194 |

Vietnam |

2004 |

RU ULU |

2024-10-05 01:11 (UTC+3) |

SG SIN Around Africa |

2024-11-16 15:00 (UTC+8) |

Registered owner SAO VIET PETROL TRANSPORTATION 3rd Floor, Viet Tower Building, 1, Thai Ha, Trung Liet Ward, Dong Da District, Hanoi City, Vietnam.Ship manager/Commercial manager SAO VIET PETROL TRANSPORTATION 3rd Floor, Viet Tower Building, 1, Thai Ha, Trung Liet Ward, Dong Da District, Hanoi City, Vietnam. |

|

SEAGRACE Crude Oil Tanker |

9934826 |

157747 |

Malta |

2022 |

RU ULU |

2024-10-05 21:49 (UTC+3) |

IN SIK Around Africa

|

2024-11-17 07:00 (UTC+5) |

Registered owner WINGSHADOW MARINE LTD C/O: Thenamaris (Ships Management) Inc 16, Athinas Avenue & Vorreou Street, Vouliagmeni, 166 71, Athens, Greece.Ship manager/Commercial manager THENAMARIS SHIPS MANAGEMENT 16, Athinas Avenue & Vorreou Street, Vouliagmeni, 166 71, Athens, Greece |

|

MINERVA OLYMPIA Crude Oil Tanker |

9787194 |

114661 |

Greece |

2019 |

RU VYS |

2024-10-06 07:33 (UTC+3) |

SG SIN Around Africa

|

2024-11-20 08:01 (UTC+8) |

Registered owner EMY SHIPPING SA C/O: Minerva Marine Inc 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, Greece.Ship manager/Commercial manager MINERVA MARINE INC 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, Greece. |

|

MINERVA IRIS Crude Oil Tanker |

9285861 |

103124 |

Greece |

2004 |

RU ULU |

2024-10-06 11:27 (UTC+3) |

IN SIK Around Africa |

2024-11-18 11:00 (UTC+5) |

Registered owner IRIS M ENE C/O: Minerva Marine Inc 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, Greece.Ship manager/Commercial manager MINERVA MARINE INC 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, Greece. |

|

VELIKIY NOVGOROD LNG Tanker |

9630004 |

93486 |

Gabon |

2014 |

RU VYS |

2024-10-06 12:46 (UTC+3) |

FOR ORDERS South Africa Around Africa

|

|

Registered owner BORERAY SHIPPING LTD C/O: JSC Gazprom ul Namyotkina 16, Moscow, 117997, Russia.Ship manager/Commercial manager PJSC GAZPROM ul Namyotkina 16, Moscow, 117997, Russia. |

|

OCEAN BLUE Crude Oil Tanker |

9955997 |

113385 |

Panama |

2023 |

RU ULU |

2024-10-07 11:59 (UTC+3) |

SG SIN Around Africa

|

2024-11-23 03:00 (UTC+8) |

Registered owner ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait.Ship manager/Commercial manager ARAB MARITIME PETROLEUM TRANS Arab Organization Headquarters, Building, PO Box 22525, Airport Road, 13086, Kuwait City, Kuwait. |

|

ROMEOS Oil Products Tanker |

9326897 |

74992 |

Liberia |

2008 |

RU ULU |

2024-10-08 12:48 (UTC+3) |

CHINA Around Africa |

|

Registered owner MULTU SHIPPING LTD C/O: IMS SA 6-8, Aitolikou & Kastoros Streets, 185 45, Piraeus, Greece.Ship manager/Commercial manager IMS SA 6-8, Aitolikou & Kastoros Streets, 185 45, Piraeus, Greece. |

|

ECO YOSEMITE PARK Chemical/Oil Products Tanker |

9877573 |

49999 |

Marshall Islands |

2020 |

RU ULU |

2024-10-09 20:42 (UTC+3) |

SG SIN Around Africa

|

2024-11-24 10:00 (UTC+8) |

Registered owner CALIFORNIA 19 INC C/O: Central Mare Inc 1, Vasilissis Sofias & Megalou Alexandrou Streets, Marousi, 151 24, Athens, GreeceShip manager/Commercial manager CENTRAL MARE INC 1, Vasilissis Sofias & Megalou Alexandrou Streets, Marousi, 151 24, Athens, Greece. |

|

SILVERLIGHT Crude Oil Tanker |

9577111 |

74588 |

Marshall Islands |

2012 |

RU ULU |

2024-10-19 00:14 (UTC+3) |

SG SIN Around Africa

|

2024-11-29 08:01 (UTC+8) |

Registered owner SILVERLIGHT SHIPPING & TRADING C/O: Naftomar Shipping & Trading Co Ltd 243C, Konstantinou Karamanli Avenue, Voula, 166 73, Athens, Greece.Ship manager/Commercial manager NAFTOMAR SHIPPING & TRADING CO 243C, Konstantinou Karamanli Avenue, Voula, 166 73, Athens, Greece. |

|

MINERVA PISCES Crude Oil Tanker |

9410179 |

105475 |

Malta |

2008 |

RU ULU |

2024-10-21 14:20 (UTC+3) |

SG SIN Around Africa

|

2024-12-08 00:00 (UTC+8) |

Registered owner MOSS ENTERPRISES CO C/O: Minerva Marine Inc 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, GreeceShip manager/Commercial manager MINERVA MARINE INC 141-143, Vouliagmenis Avenue & 1 Aiolou Street, Voula, 166 73, Athens, Greece. |

|

ECLIPSE I Crude Oil Tanker |

9301536 |

158933 |

Liberia |

2006 |

RU PRI |

2024-10-25 16:02 (UTC+3) |

IN MUN Around Africa

|

2024-12-13 03:00 (UTC+5) |

Registered owner ATLANTIC CRUDE HIGHWAY INC C/O: Universal Tanker Management (UTM) Ltd 147/1, Triq Santa Lucija, Valletta, VLT 1185, Malta.Ship manager/Commercial manager UNIVERSAL TANKER MGMT UTM-MAI 147/1, Triq Santa Lucija, Valletta, VLT 1185, Malta. |

|

SUNNY LIGER Oil Products Tanker |

9332626 |

74997 |

Marshall Islands |

2008 |

RU ULU |

2024-10-26 19:40 (UTC+3) |

SG SIN Around Africa

|

2024-12-10 13:00 (UTC+8) |

Registered owner SUNNY LIGER SHIPPING LLC Trust Company Complex, Ajeltake Road, Ajeltake, Majuro MH 96960, Marshall Islands.Ship manager/Commercial manager SUNNY LIGER SHIPPING LLC Trust Company Complex, Ajeltake Road, Ajeltake, Majuro MH 96960, Marshall Islands. |

To be continued...

* * *

The publication has been created with the support of the Friedrich Ebert Foundation(FES). The position of the Friedrich Ebert Foundation does not necessarily reflect the opinion of the authors.

The publication has been created with the support of the Friedrich Ebert Foundation(FES). The position of the Friedrich Ebert Foundation does not necessarily reflect the opinion of the authors.

More on the topic

- 12.03.2025 Russian Crude Oil Imports to the EU Embargo: Database of February 2025 Violations

- 11.03.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of February 2025 Violations

- 05.03.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: February 2025 Database

- 24.02.2025 Andriy Klymenko: «La “flotte fantôme russe“ est un mythe inventé par commodité»

- 22.02.2025 Russian Baltic Sea Ports Petroleum Products Imports to the EU Embargo: Database of January 2025 Violations

- 20.02.2025 Andrii Klymenko: "The Shadow Fleet and Price Ceiling are Myths Contrived by the US for its Own Convenience"

- 13.02.2025 Russian Black Sea Ports Oil Product Imports to the EU Embargo: Database of January 2025 Violations

- 12.02.2025 Russian Crude Oil Imports to the EU Embargo: Database of January 2025 Violations

- 10.02.2025 Russian Crude Oil Imports to the EU Embargo Through the Russian Baltic Sea Ports: Database of January 2025 Violations

- 06.02.2025 Maritime Exports of Russian Crude Oil and Petroleum Products Through its Black Sea Ports: January 2025 Database

- 21.01.2025 The Problem of Assessing Russia's Economic Capacity to Wage War Under Sanctions. Part 6

- 21.01.2025 Ukrainian Black Sea Corridor as Russia's Key Military Target. Part 5